In Jackson Hole, Wyoming this morning Fed chairman Jerome Powell said the strong US economy justifies raising interest rates, but in a gradual fashion. Most take this to mean the Fed will raise rates in September and perhaps once more before the year ends.

From "Monetary Policy in a Changing Economy" Transcript

“As the most recent FOMC statement indicates, if the strong growth in income and jobs continues, further gradual increases in the target range for the federal funds rate will likely be appropriate.

The economy is strong. Inflation is near our 2 percent objective, and most people who want a job are finding one. My colleagues and I are carefully monitoring incoming data, and we are setting policy to do what monetary policy can do to support continued growth, a strong labor market, and inflation near 2 percent.”This expected 0.25% rate increase in September would bring the Fed Funds rate to a range of 2.00% to 2.25% from its current range of 1.75% to 2.00%.

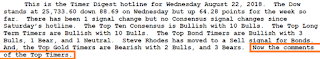

I discussed this in my latest newsletter and Timer Digest wrote about it this weekend:

Here are charts of the four major US stock market indexes I track showing that in fact the markets were happy with the Fed raising rates.

To get my "Special Email Alerts" and the "Auto Buy Sell Table" where I list ahead of time what stocks I will buy at what prices during declines and what I will sell during the advances. These buys and sells are at preset target prices you can use to set limit orders at your broker.

Subscribe NOW and get

the August 2018 Issue for FREE!!!

the August 2018 Issue for FREE!!!

Treasury Bond Rates vs the Fed Funds rate

No comments:

Post a Comment