On Saturday February 25, 2017 Warren Buffett released his 2017 Annual letter to shareholders for his Berkshire Hathaway (BRKA) performance through December 31, 2016. I wrote a detailed article about this for Seeking Alpha you can read at:

Summary:

Buffett Listed 3 stocks of note with prices within 6% of his average purchase price.

He did not add to two top holdings that went down in 2016, an up year for the market.

Apple was a new position for 2016.

Any short-term market pullbacks to the average price Buffett paid could be a buying opportunity to do better than Buffett.

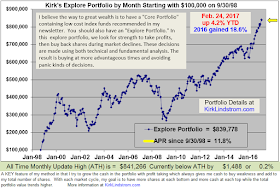

My Core and Explore Performance vs Warren Buffett's BRKA:

I'll use this article to add additional charts people request in comments here.

2/27/17 4:01 PM PST Update:

Kirk Lindstrom's Investment Letter:

Subscribe NOW & get the February 2017 Issue for FREE!!!

I'll use this article to add additional charts people request in comments here.

2/27/17 4:01 PM PST Update:

- According to Jim Cramer, on CNBC this morning Buffett said he now owns 133 million shares of Apple, making it equal to his holdings in Coke!

2/28/17 7:09 AM PST Update:

- Doc Hopey wrote in the comments section of my article: "I am often impressed about the confidence regarding the depth of a moat. "Apple has a much bigger moat than IBM". How can you be so sure? I'd remember a lot of stocks in the tech business, that I guess I'd thought having a strong moat. Blackberry, Nokia, Kodak, Polaroid, Yahoo... Most of those have been (nearly) gone long before I started investing. Nonetheless in the rearview mirror all of those brands lost their mojo for technical revolutions. (Mostly) All of those consumer brands are gone and I am not sure if I would have gotten that right. Not so IBM."

Apple vs Sony Graph