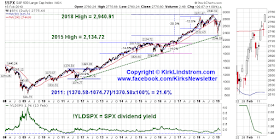

Chart showing the S&P 500 touching a very strong support line (in green) today:

There is certainly blood in the streets now, especially for the once high flying "FAANG" stocks:

Yesterday on Christmas, President Trump told reporters, " So I think it's a tremendous opportunity to buy. Really a great opportunity to buy."📈💲

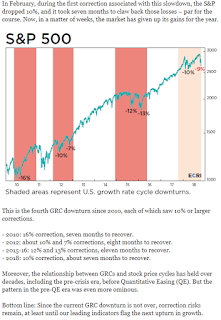

We raised a lot of cash when the markets were much higher and other investors were "greedy" and now we have been buying while others are "fearful."

Nobody knows for sure but you can see from my long-term S&P 500 chart that the market has corrected 20.3% from its peak all the way down to this very strong support line.

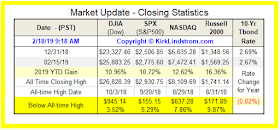

Feb 18, 2019 Update: President Trump was correct. It WAS a great time to buy! I sure did some "Christmas Shopping" and now my Explore Portfolio is at a record high!

Holiday Email List

Subscribe NOW and get

the January 2019 Issue for FREE!!!

the January 2019 Issue for FREE!!!

I've taken some profits so if we test the lows or even retrace some, I have cash to pick up more bargains. But if the market continues higher, perhaps to make new record highs, then I'l just keep taking profits! There is an old saying "Bull and bears make money while pigs get slaughtered."

Discuss this article on my "Investing for the Long Term" Facebook Group here.

.