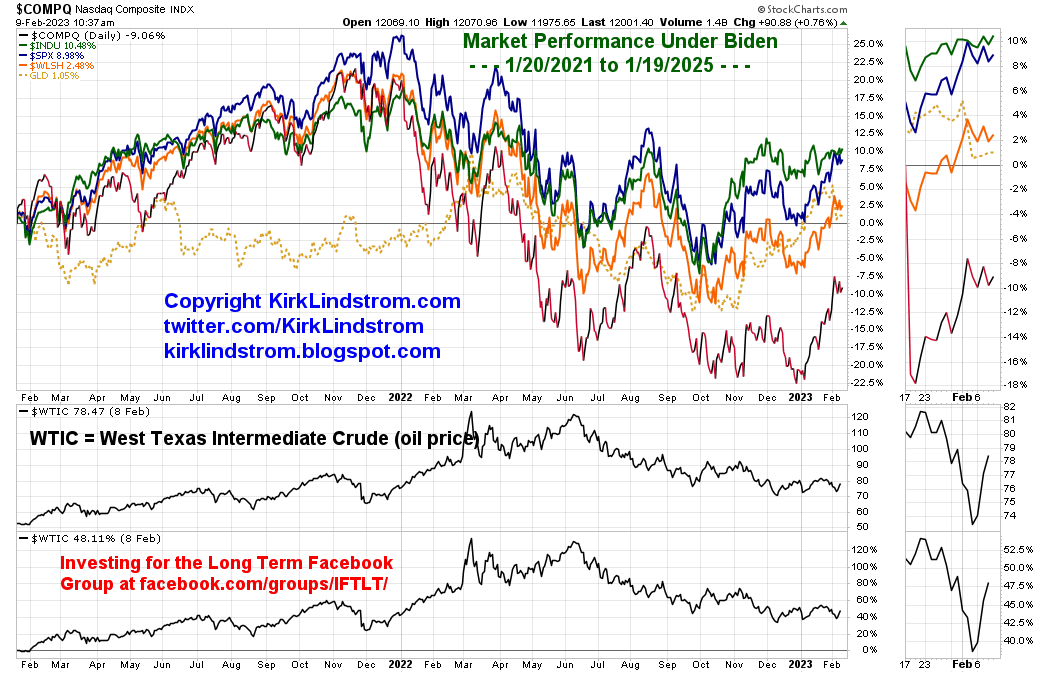

🐂📈Kirk Lindstrom's Investor Bull/Bear Sentiment Charts for 2/23/23 📉🐻

Reminder, you can subscribe or follow this feed and get sent emails by Google when I post new charts and articles. Just click "Follow" below.

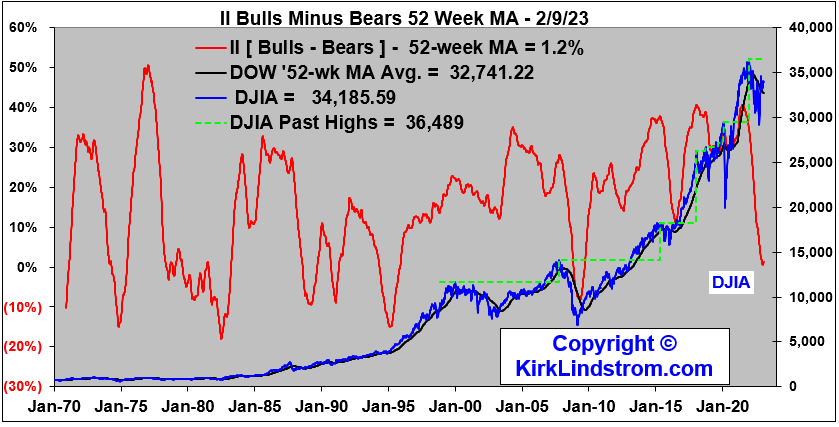

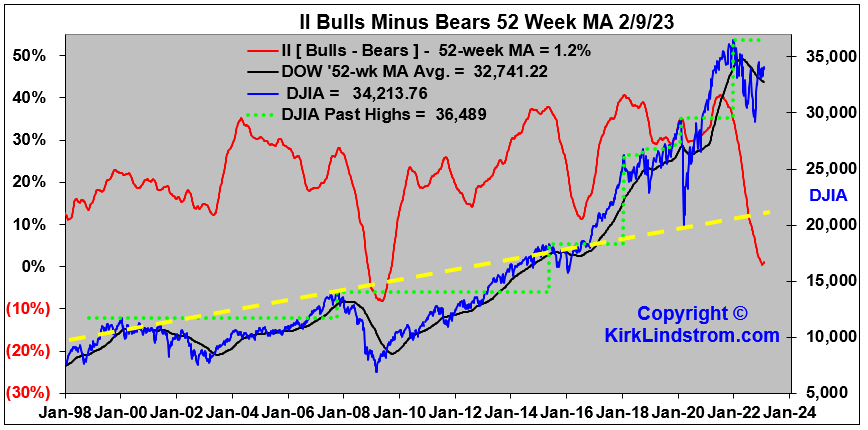

II Investors Intelligence & AAII (American Association of Individual Investors) Sentiment Updates

II Bulls and Bears Sentiment Graphs

- % Bulls = 44.4

- % Bears = 26.4

- % Bulls / (% Bulls +% Bears) = 62.7

Click charts to view full size

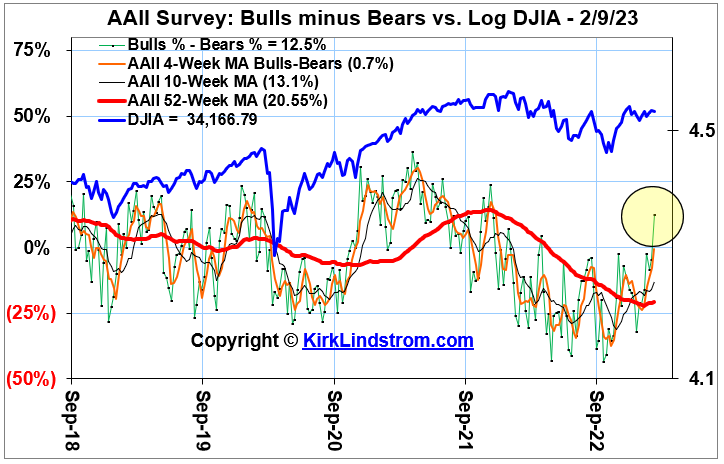

AAII Bulls and Bears Sentiment Graphs: The AAII Investor Sentiment Survey measures the percentage of individual investors who are bullish, bearish, and neutral on the stock market for the next six months.

As of 2/23/23, the AAII members are:

- Bullish: 21.6%

- Neutral: 38.6%

- Bearish: 39.8%

- Current Data from https://www.aaii.com/sentimentsurvey

The Global Investor Confidence Index increased to 77.5, up 1.1 points from January’s revised reading of 76.4. The increase was led by a 5.8 point rise in Asian ICI to 98.2, as well as a 4.1 point increase in European ICI to 106.4. North American ICI, meanwhile, fell 0.3 points to 72.8.

The Investor Confidence Index was developed at State Street Associates, State Street Global Markets research and advisory services business. It measures investor confidence or risk appetite quantitatively by analyzing the actual buying and selling patterns of institutional investors. The index assigns a precise meaning to changes in investor risk appetite: the greater the percentage allocation to equities, the higher risk appetite or confidence. A reading of 100 is neutral; it is the level at which investors are neither increasing nor decreasing their long-term allocations to risky assets. The index differs from survey-based measures in that it is based on the actual trades, as opposed to opinions, of institutional investors.

CPC The more recent signals are left to the user. See page 6 of my February 2023 Newsletter for more about what this indicator means to me.

NAAIM member firms who are active money managers are asked each week to provide a number which represents their overall equity exposure at the market close on a specific day of the week, currently Wednesdays. Responses can vary widely as indicated below. Responses are tallied and averaged to provide the average long (or short) position of all NAAIM managers, as a group.

Range of Responses:

- 200% Leveraged Short

- 100% Fully Short

- 0% (100% Cash or Hedged to Market Neutral)

- 100% Fully Invested

- 200% Leveraged Long

- Source

More Sentiment Information : Sentiment charts are covered on page 6 of my newsletter with updates during the year for what the different types of sentiment charts mean to me. This blog is an easy place to give my subscribers updates of charts too numerous to add each month to the newsletter but they might find worthwhile. And for others... they can window shop or ignore as it suits them.

Kirk Lindstrom's Investment Letter

To see what stocks and ETFs are in my portfolio and get a full list of on my price targets to both take profits or buy more:

Subscribe NOW and get

the February 2023 Issue for FREE!!!

(If you mention this ad) Reminder, you can subscribe to this feed for free to get sent emails by Google when I post new charts and articles. Just click "Follow" below.