Currently the market is testing the October 10th and 27th lows. If it can do it with a lower peak VIX and lower volume, then this is a good sign for a rally, if not a cyclical bull market.

Currently the market is testing the October 10th and 27th lows. If it can do it with a lower peak VIX and lower volume, then this is a good sign for a rally, if not a cyclical bull market. At the same time, investors are so scared of risk they bid the 13-week treasury bill down to 0.05% yesterday.

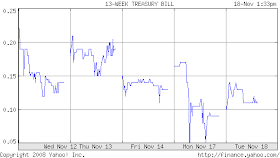

At the same time, investors are so scared of risk they bid the 13-week treasury bill down to 0.05% yesterday.

For more rates, see US Treasury Rates at a Glance

Historically, when investors act irrationally, doing the opposite provides large rewards for those who have the ability to look to the long term. Just as investors poured into risky internet stocks with no earnings to make the March 2000 top, dumping quality growth companies that pay dividends for the safety of 0.05% Treasury bills is not rational in the long-term.

"Buy when there is blood in the streets"Warren Buffett is a buyer. See Warren Buffett Buy Signal.

Nathan Rothschild, the British member of the Rothschild banking family in the early 19th Century commenting on the best time to buy. He is reputed to have made a fortune from the Battle of Waterloo stock market panic. His full quote is believed to be "Buy when there is blood in the streets, even if the blood is your own."

Short-term, the market can do anything but for the long-term, I agree with people like Warren Buffett. When you get the VIX and other fear indicators showing investors are acting irrationally out of fear, rewards are there for those who can look to the long term. To learn what I have been buying with my own money and recommending to my newsletter subscribers, Subscribe TODAY and get the November 2008 issue for FREE!

Definition: The VIX is the Chicago Board Options Exchange (CBOE) Volatility Index. The VIX shows the market's expectation of 30-day volatility. It is calculated from both calls and puts that are near the money. The VIX is a popular measure of market risk thus making it another great contrarian “fear indicator” useful for short-term market timing.

Market Timing Disclaimer: No sentiment indicator, or any indicator for that matter, is 100% reliable. I look at sentiment as head winds and tail winds. When sentiment is terrible, then it acts like a tail wind for your returns where you could see further declines, but long term, it is best to be buying when most others are selling. Likewise, if we see sentiment get too bullish, then I would consider lowering my portfolio asset allocation. It seldom pays to be buying stocks when EVERYONE is talking about stocks and how much money they are making at cocktail parties.

==> Very Best CD Rates with FDIC <==

In addition, I am not market timing but for a small portion of my explore portfolio. I use market-timing indicators to tell me it is a good time to buy so I can add to positions when the market is down and thus help me overcome my fear to rebalance back to my target asset allocation. Likewise, when the market-timing indicators are saying to sell, they usually come when the markets are high where I want to be taking profits. The market timing indicators at market highs help me get over my greed and take profits. Now and then, I may make an asset allocation adjustment based on the Fed Model saying the market is over or under valued. Some call that market timing, but I do not. Also, I have stayed pretty close to 70:30 equities-fixed for many years despite the Fed model which has its own set of flaws.

I am still dumbfounded why the ISEE is not showing any where near the level of fear that the VIX is showing.

ReplyDeleteLarry, check out Market volatility has outpaced 1987's, and is set to surpass 1929's.

ReplyDeleteAs for ISEE, the absolute level has nearly zero correlation with the market but I've found some usefulness using the second derivative of ISEE sentiment.

I think it shows how no single indicator is reliable but if you look at enough of them, then they tell a reasonable story about the odds of the market direction in the short term measured in weeks.