Jeremy Siegel (author of Stocks for the Long Run

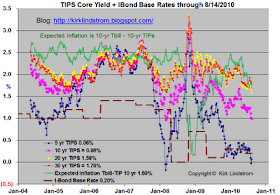

A similar bubble is expanding today that may have far more serious consequences for investors. It is in bonds, particularly U.S. Treasury bonds. Investors, disenchanted with the stock market, have been pouring money into bond funds, and Treasury bonds have been among their favorites. The Investment Company Institute reports that from January 2008 through June 2010, outflows from equity funds totaled $232 billion while bond funds have seen a massive $559 billion of inflows.The warning is not just for regular bonds but also TIPS. (See chart of TIPS rates below article)

We believe what is happening today is the flip side of what happened in 2000. Just as investors were too enthusiastic then about the growth prospects in the economy, many investors today are far too pessimistic.

The rush into bonds has been so strong that last week the yield on 10-year Treasury Inflation-Protected Securities (TIPS - More Info) fell below 1%, where it remains today. This means that this bond, like its tech counterparts a decade ago, is currently selling at more than 100 times its projected payout.Jeremys Siegel and Schwartz recommend stocks for both income and inflation protection

Shorter-term Treasury bonds are yielding even less. The interest rate on standard noninflation-adjusted Treasury bonds due in four years has fallen to 1%, or 100 times its payout. Inflation-adjusted bonds for the next four years have a negative real yield. This means that the purchasing power of this investment will fall, even if all coupons paid on the bond are reinvested. To boot, investors must pay taxes at the highest marginal tax rate every year on the inflationary increase in the principal on inflation-protected bonds—even though that increase is not received as cash and will not be paid until the bond reaches maturity.

From our perspective, the safest bet for investors looking for income and inflation protection may not be bonds. Rather, stocks, particularly stocks paying high dividends, may offer investors a more attractive income and inflation protection than bonds over the coming decade.and

Due to economic growth the dividends from stocks, in contrast with coupons from bonds, historically have increased more than the rate of inflation. The average dividend income from a portfolio of S&P 500 Index stocks grew at a rate of 5% per year since the index's inception in 1957, fully one percentage point ahead of inflation over the period. That growth rate includes the disastrous dividend reductions that occurred in 2009, the worst year for dividend cuts by far since the Great Depression.What many bond investors fleeing the risk of equities fail to see is the risk of rising rates on bond funds. The article points out the risk:

If 10-year interest rates, which are now 2.8%, rise to 4% as they did last spring, bondholders will suffer a capital loss more than three times the current yield.What I own: In addition to equities, I am currently long TIPS, TIPS funds VIPSX (charts and quote) and FINPX (chart and quote) and Series-I Bonds (the majority have a 3.0% base rate) in my personal account. I-Bonds will not lose net asset value if rates surge but new i-bonds currently pay very little above inflation so I have most of my cash in CDs and savings accounts paying over 1.0%. I personally own no bonds or bond funds not indexed to inflation. I also own a REIT fund. REITs pay good income and should do well in a growing economy but they could suffer if we have a double dip recession.

[3 x 2.8% = 8.4%]

In both the "core" and "explore" portfolio in "Kirk Lindstrom's Investment Letter" I sold all bonds not indexed to inflation with the majority of my fixed income (about 30% of the total) in cash and CDs. For yield and diversification, I have a REIT fund in the "Core Portfolio" in "Kirk Lindstrom's Investment Letter" that has done well the past two years and should continue to do well if the economy avoids a double dip recession.

For the Future: I am strongly considering selling my TIPS funds to lock in nice gains and perhaps wait for them to pay a better spread similar to when I bought them. The individual TIPS I bought pay inflation plus better than 1.0% so I can hold those to maturity and do very well with or without inflation.

More information about

- TIPS or Treasury-Inflation Protected Securities

- Series-I Bonds

- You can read the full Siegel/Schwartz article by putting "The Great American Bond Bubble" in a search engine.

US Treasury Rates at a Glance

Beware of Annuities

Chart showing 5-YR TIPS rate below Zero

Click to see full size chart

No comments:

Post a Comment