ECRI's WLI & WLI Growth Rate Both Up

The Economic Cycle Research Institute, ECRI - a New York-based independent forecasting group, released their latest readings for their proprietary Weekly Leading Index (WLI) this morning. (More about ECRI)

For the week ending September 24, 2010

KEY ECRI Articles:

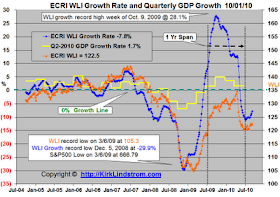

- WLI is 122.5, up from the prior week's reading of 122.2.

- The lowest reading for WLI this year was 120.4 for the week ending July 16.

- WLI growth moved higher to minus 7.8% from minus 8.7% a week ago.

- The last positive reading for WLI growth was for the week ending May 28, 2010 when it stood at positive 0.1%.

Chart of WLI and WLI growth vs GDP Growth

Since ECRI releases their WLI numbers for the prior week and the stock market is known in real time, you can often get a clue for next week's WLI from the weekly change in the stock market.

More Charts:

Notes:

- The WLI for the week ending 10/1/10 will be released on 10/8/10.

- Occasionally the WLI level and growth rate can move in different directions, because the latter is derived from a four-week moving average.

- ECRI uses the WLI level and WLI growth rate to HELP predict turns in the business cycle and growth rate cycle respectively. Those target cycles are not the same as GDP level or growth, but rather a set of coincident indicators (including production, employment income and sales) that make up the coincident index. Based on two additional decades of data not available to the general public, there are a couple of occasions (in 1951 and 1966) when WLI growth fell well below negative ten, but no recessions resulted (although there were clear growth slowdowns).

Before you claim understanding of ECRI's WLI, make sure you read the article "ECRI Weekly Leading Indicators Widely Misunderstood."

Disclosure: I am long the exchange traded fund for the S&P500, SPY charts and quote, in my personal account and in the "Explore Portfolio" in "Kirk Lindstrom's Investment Letter.""Bottom line, neither the “experts” predicting that the sky is falling based on the WLI, nor the other “experts” indulging in misinformed WLI-bashing in an effort to discredit the super-bears, have a real clue to what the WLI is all about... A slowdown in U.S. economic growth is imminent, but a new recession is not."

KEY ECRI Articles:

- Sept. 24, 2010 ECRI - Premature to Predict New Recession

- Dec. 04, 2009: ECRI Warns of Lasting High Unemployment Despite Economic Recovery

- July 31, 2009: ECRI Predicts End of Home Price Downturn

- July 21, 2009: ECRI Predicts The End of the Recession is Imminent

- April 3, 2009: ECRI Says US Business Cycle Recovery Ahead

- March 28, 2008: ECRI Calls it "A Recession of Choice"

No comments:

Post a Comment