2016 (Articles in Red are KEY)

Dec 05 State and Local Sales Tax Rates for 2016 - Chicago, IL has the highestDec 03 State Income Tax Rates Map For 2016 California has highest rate @ 13.3%

Nov 02 2CS Sentiment Indicator Falls Below 30

Nov 02 Rates Up To 6.41% Now For Series I Treasury Bonds I Bonds at 2.76%

Oct 26 2017 Social Security COLA: Cost-of-Living Adjustment (COLA) for 2017

Oct 11 Special Promotion for LinkedIn & Facebook - Get October's Issue for Free

Sept 30 Citigroup's Panic - Euphoria Model is back in its "Panic" Zone

Sept 8 2016 Year End S&P500 Price Targets for Major Wall Street Firms

Sept 7 Bob Brinker's Market Update for September 2016

Aug 25 SPY 1% Off Record High While Market Sentiment Continues Recovery

July 7 How Long Will You Live? Life & Death Issues - Life Expectancy

May 29 US Treasury Interest Rates vs S&P500 - Interest Rates vs the Stock Market

May 09 Jets.com Jet Card Pricing

April 11 Best CD Rates - Highest CD Rate Survey for April 2016

April 07 Newest Sentiment Indicator Very Bullish For SPY Even After a 14% Gain

Apr 03 Citigroup's Panic/Euphoria Model from Citi Investment Research

Mar 14 Make Money In A Flat Market With Asset Allocation & Market Volatility

Mar 13 Winning the Zigs, losing on the Zags - Why small investors usually do poorly

Mar 13 Jim Cramer's "Action Alerts Plus" Charitable Trust Portfolio Performance

Mar 10 SPY Up 10.1% Since The Tradable Low - Resistance At 200 Day MA

Mar 03 SPY Up 9.5% Since The Tradable Low - Buy Pullbacks Or Sell?

Feb 26 SPY Continues Rally After Sentiment Charts Suggested Tradable Low

Feb 23 2CS Indicator Back Above 20 After Market Rallies 7.5%

Feb 18 SPY Up Sharply Since Sentiment Charts Suggested Tradable Low

Feb 11 With SPY Down 14% Again, Sentiment Charts Suggest Tradable Low

Feb 04 With SPY Still Down 10%, Sentiment Charts Suggest A Tradable Bottom

Jan 31 Los Altos Real Estate - Home prices gain another 15.7% in 2015

Jan 26 Tom Drake's 2CS Sentiment Indicator - Buy Signal

Jan 14 Sentiment Charts Reaching Blood In The Street Levels - SPY Down 11%

Jan 14 Timer Digest Market Timer of the Year Awards - 3rd Place long & short term

Jan 08 New Issue CD Rates At Fidelity

Jan 07 Star One Credit Union Savings Account and CD Rates

Jan 07 Weekly Sentiment Charts Falling With SPY Down 8%

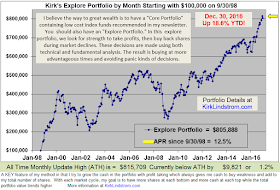

Kirk Lindstrom's Investment Letter

(My SPECIAL ALERT emails will begin immediately plus access to all past issues while your 1 year, 12 issue subscription will start with the December issue.)