Market Update - The US stock markets all made record highs this month and closed the year less than three percent below those record highs. This table summarizes the data:

Click images to see full size

This graph shows the market data graphically for 2016 through 12/30/16.

Note the table above shows:

- The S&P500 is 22.40% from its February 11th closing low, the day I wrote this free article "With SPY Down 14% Again, Sentiment Charts Suggest Another Tradable Low"

- The Russell 2000 (small cap index) is up 42.30% since the February 11th low.

- I didn't just write about this being a great time to buy, I sent out special alert emails to my newsletter subscribers while the market was bottoming in January and February as this summary of my email headers shows:

- Feel free to verify with my subscribers who post on my Kirk Lindstrom's Investment Letter Facebook Page.

This graph shows the S&P500 ETF SPY and its dividend back to 1992.

This graph puts the Dow Jones Industrial Average into perspective using a log chart. Many pundits on TV say lowering the corporate tax rate will allow hundreds of billions of dollars to return to the US where some will be used for share buybacks. This buying by companies plus scared bond investors looking for return, could easily drive the Dow back to the center blue line... of course a bear market could also drive it to the lower blue line first so I take profits at new highs to have funds to buy the declines and thus beat the market over time like very few others have.

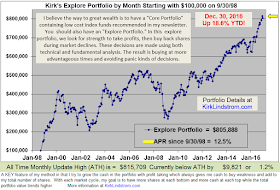

Kirk Lindstrom's Investment Letter:

Congratulations to everyone who is in the stock market this year!

Happy New Year!

No comments:

Post a Comment