"I'm now a zealous convert. A true believer in Tesla. That is why I can't commit in Netflix." followed by his BUY BUY BUY sound effect.and

“Cult product? Check. Sound balance sheet? Check. Charismatic Leader? Check,” the host said. “If you’re going to invest in a battleground stock, Tesla’s got all the ingredients of a winner.”

He made a long case for why he now likes it including:

- His daughter, who is not a car person, liked it for a drive from Portland, Oregon to SF California.

- His wife says the solar roof panels are the same price as regular roof panels so she wants to get them. (I wonder if they have an expensive slate roof as I doubt they are as cheap as asbestos shingles or even my more expensive concrete tile roof.)

Cramer gets a lot of headlines but I believe it has been years since he's been able to beat just buying and holding an index fund for his recommended stocks.

He had a great record as a hedge fund manager but he admitted in this video that he did some things that are not allowed... then or today. Go to 2:20 to 3:40 where he admits to doing what was and is "blatantly illegal."

To me, that explains why he can't beat the markets without cheating these days... it is far different than market manipulation that he explains in the whole video such as calling reporters to spread news about Apple to move the stock!

- 6:10 Hit the brokerage houses with a series of orders that can push it down

- 6:15 Then leak it to the press

- 6:17 then get it on CNBC, that is also very important.

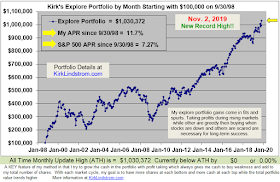

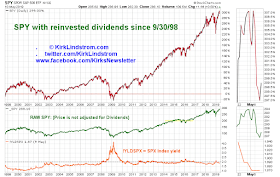

My performance without cheating.....

Kirk's Explore Stock Performance Estimate for 2019 YTD

Kirk's Explore Stock Performance Estimate for 2019 YTD

Kirk Lindstrom's Investment Letter

Don't miss out!

Subscribe NOW and get the December 2019 Issue for FREE!

Subscribe NOW and get the December 2019 Issue for FREE!