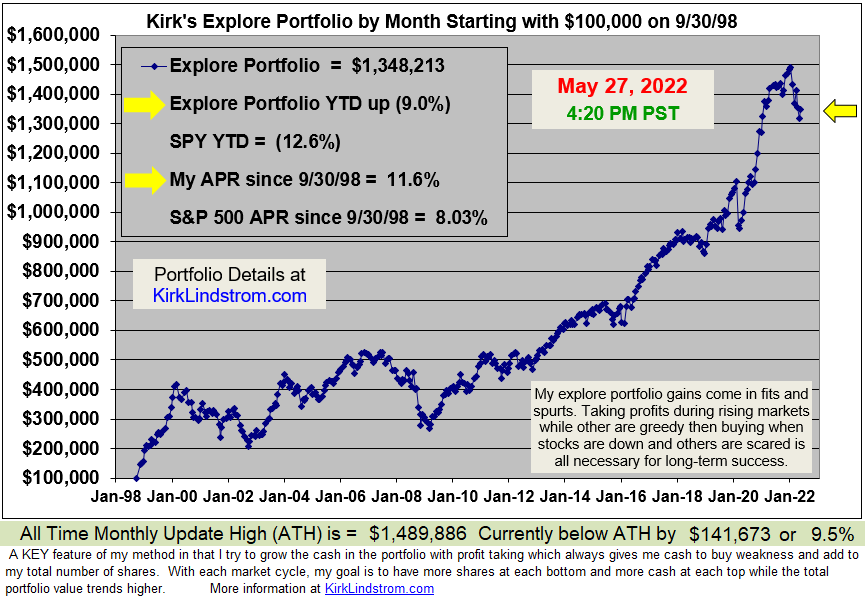

As of Friday's close, the Nasdaq and Wilshire 2000 small cap indexes remain in bear markets while the S&P 500 has rallied off its bear market low back into "correction" territory while the Dow never reached the 20% down bear market threshold.

Interest rates have come down some but gasoline prices in some parts of California are OVER $7.00 a gallon!

S&P 500 Observation: Note how the recent 20.9% "bear market correction" kept the S&P 500 contained by the channel made by the much quicker, 35.3% COVID-19 bear market in 2020.

|

| Market Update for May 27, 2022 |

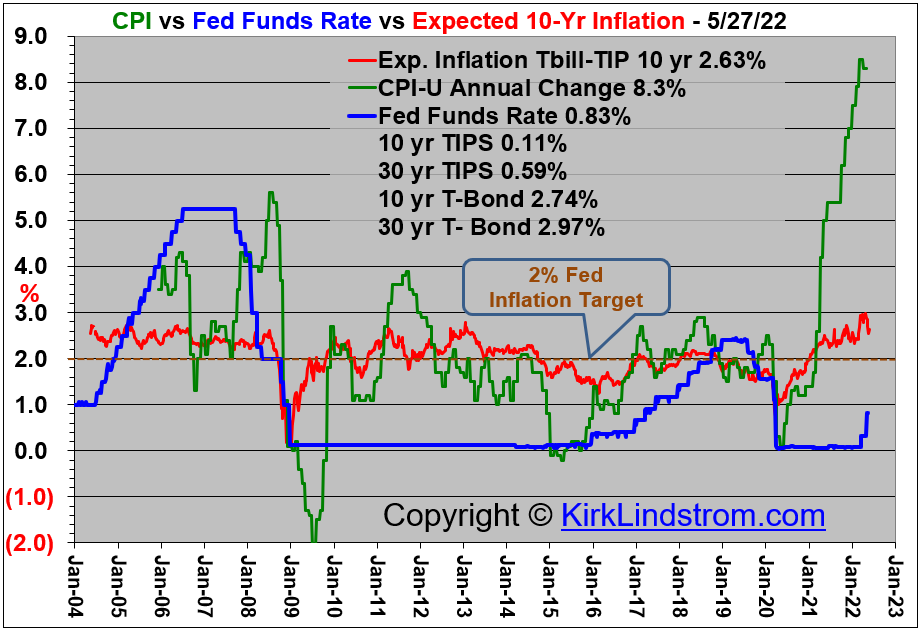

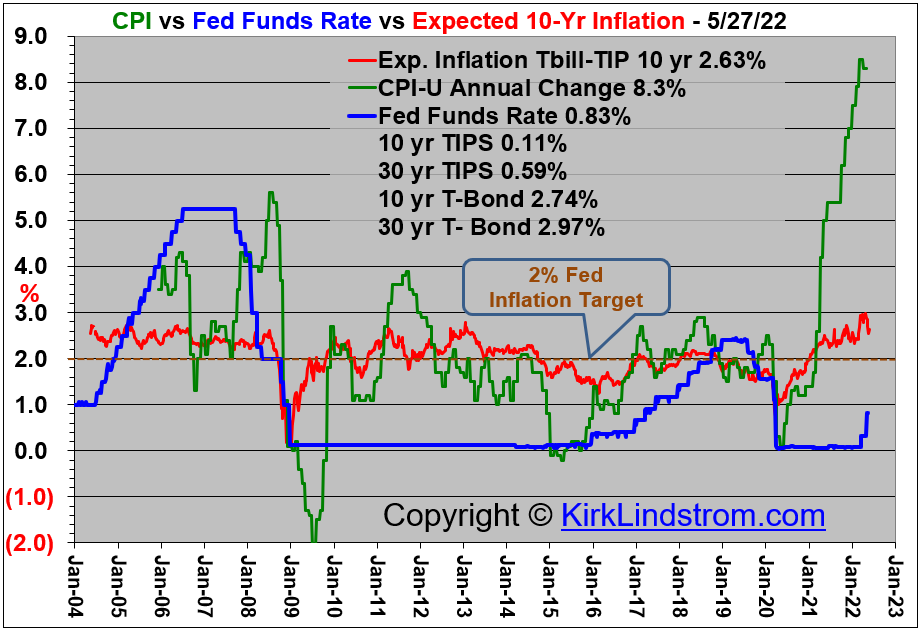

Interest Rates: After spending some time above 3.00%, the 30-year and 10-year Treasury Bonds are now back below 3.00, perhaps an indication that inflation has peaked and the US economic growth is slowing, i.e. GDP growth is falling.

|

| US Treasury Interest Rates Graph |

|

| CPI vs Expected Inflation Rate |

|

| Average Gasoline Prices in the US |

Gasoline Prices are higher here in California with many stations over $7 per gallon!

Sentiment Charts:

|

| "Nasdaq New Highs - New Lows" |

|

| Graph of the American Association of Individual Investors (AAII) Bulls Minus Bears Sentiment Indicator vs the Dow. |

|

| CNN Fear & Greed Index |

More Articles by Kirk Lindstrom:

No comments:

Post a Comment