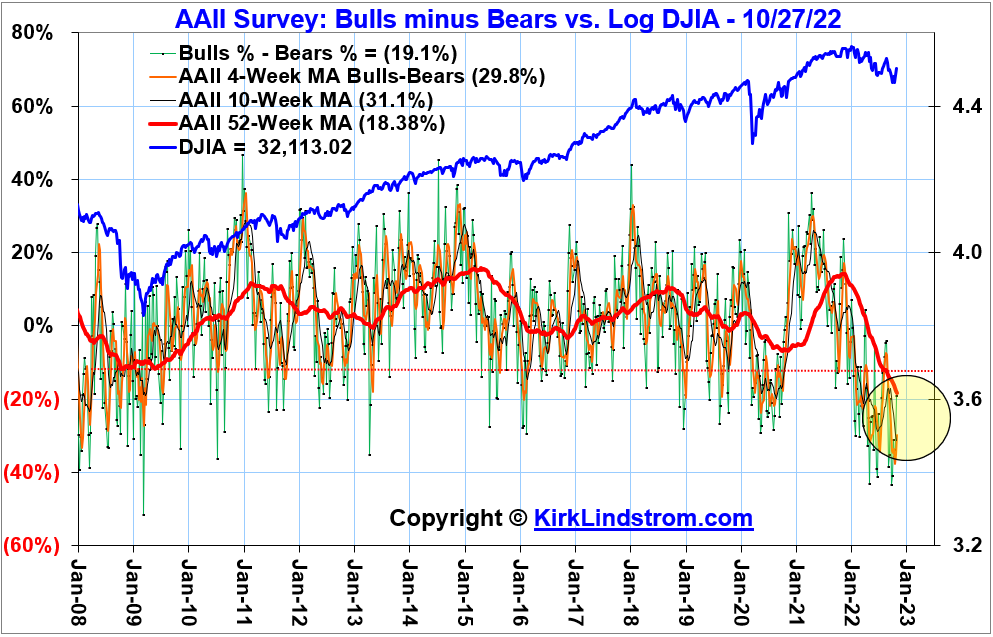

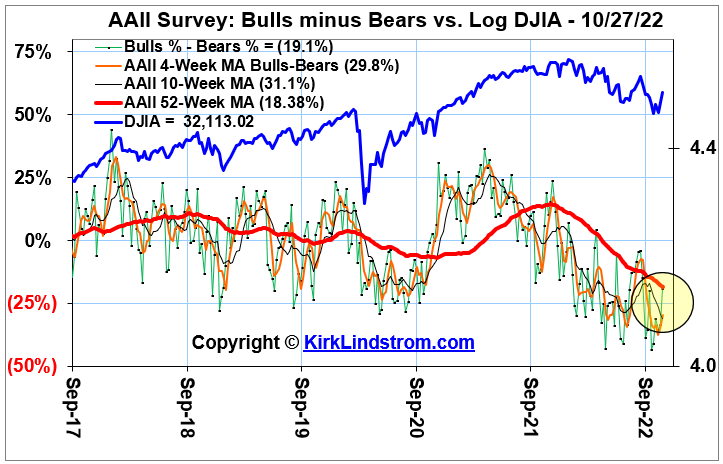

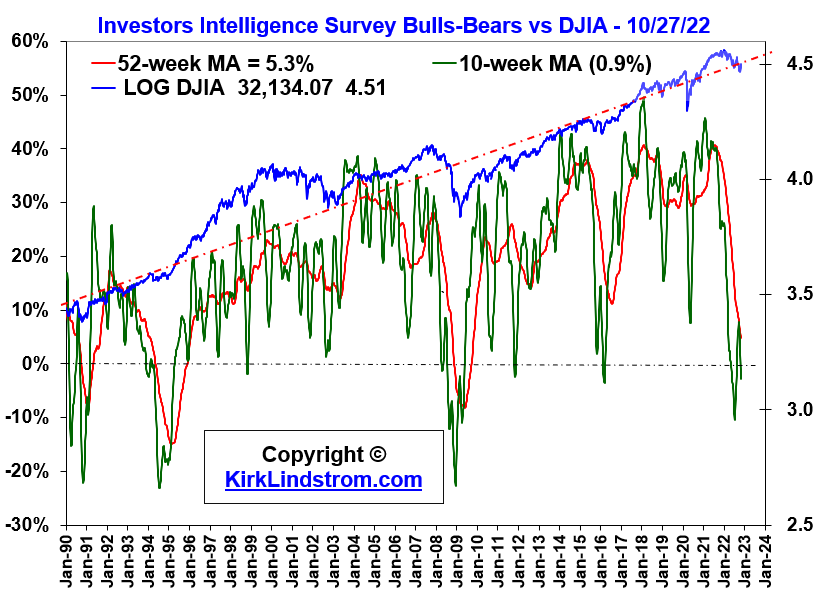

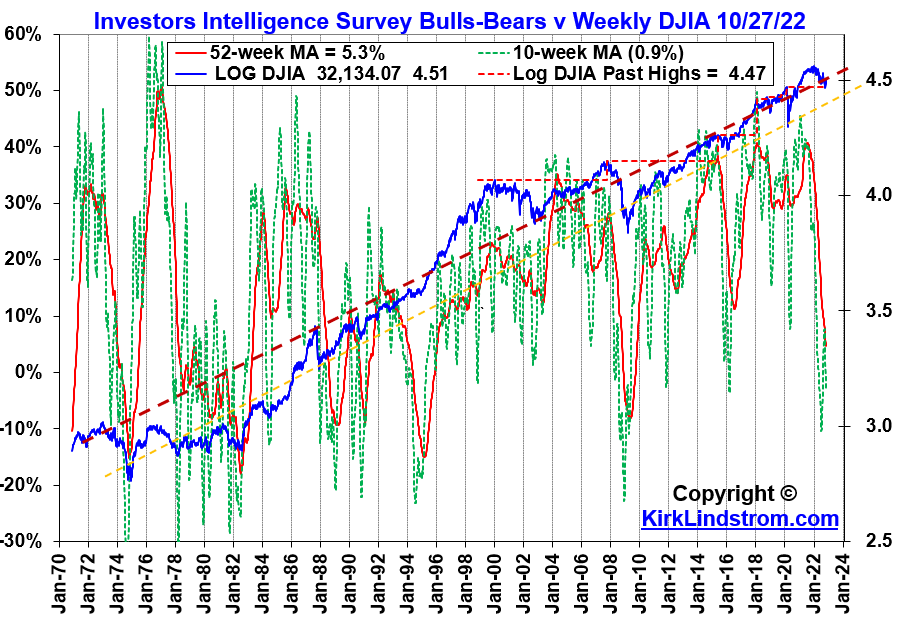

🐂📈Kirk Lindstrom's Investor Bull/Bear Sentiment Charts for 10/27/22 📉🐻

Reminder, you can subscribe or follow this feed and get sent emails by Google when I post new charts and articles.

Graph of the American Association of Individual Investors (AAII) Bulls Minus Bears Sentiment Indicator vs the Dow.

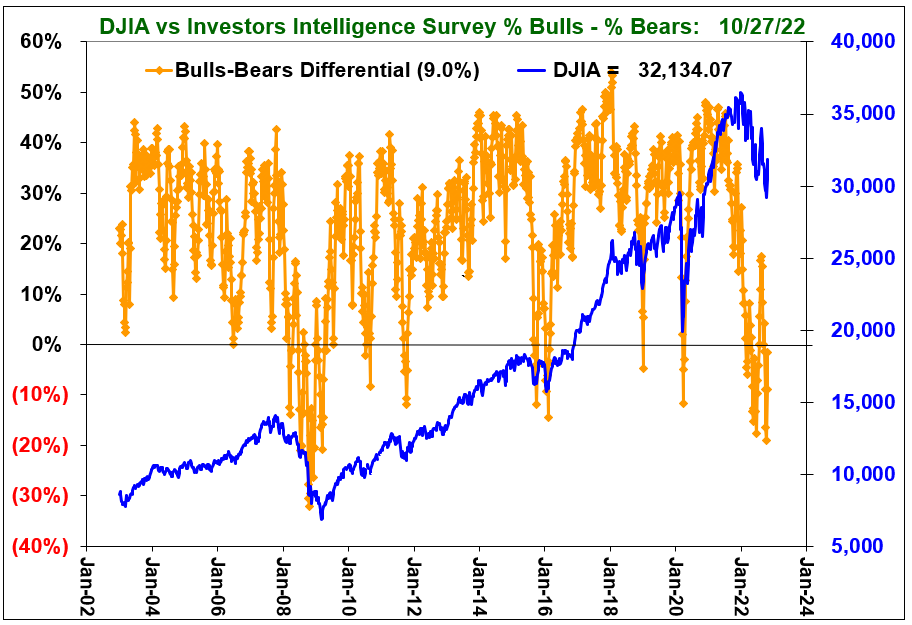

Graph of the II, Investors Intelligence, Bulls and Bears Survey vs Log Dow Graphs

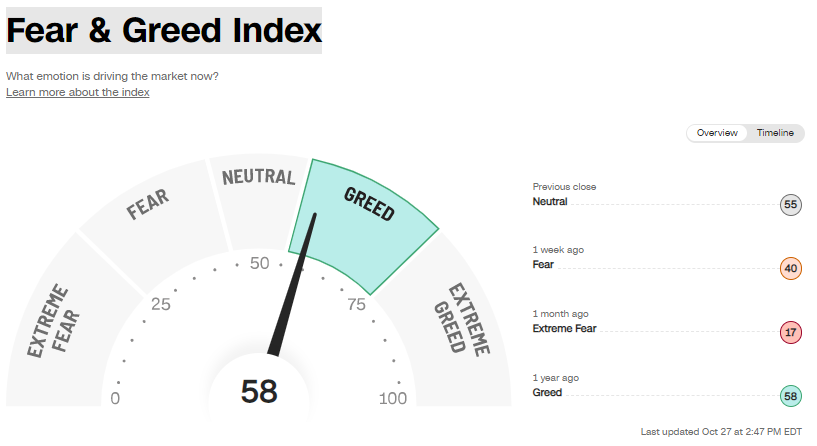

CNN's Fear & Greed Index

CPC Put Call Ratio

Kirk Lindstrom's Investment Letter

the October 2022 Issue for FREE!!!

(If you mention this ad)