Market Sentiment Update

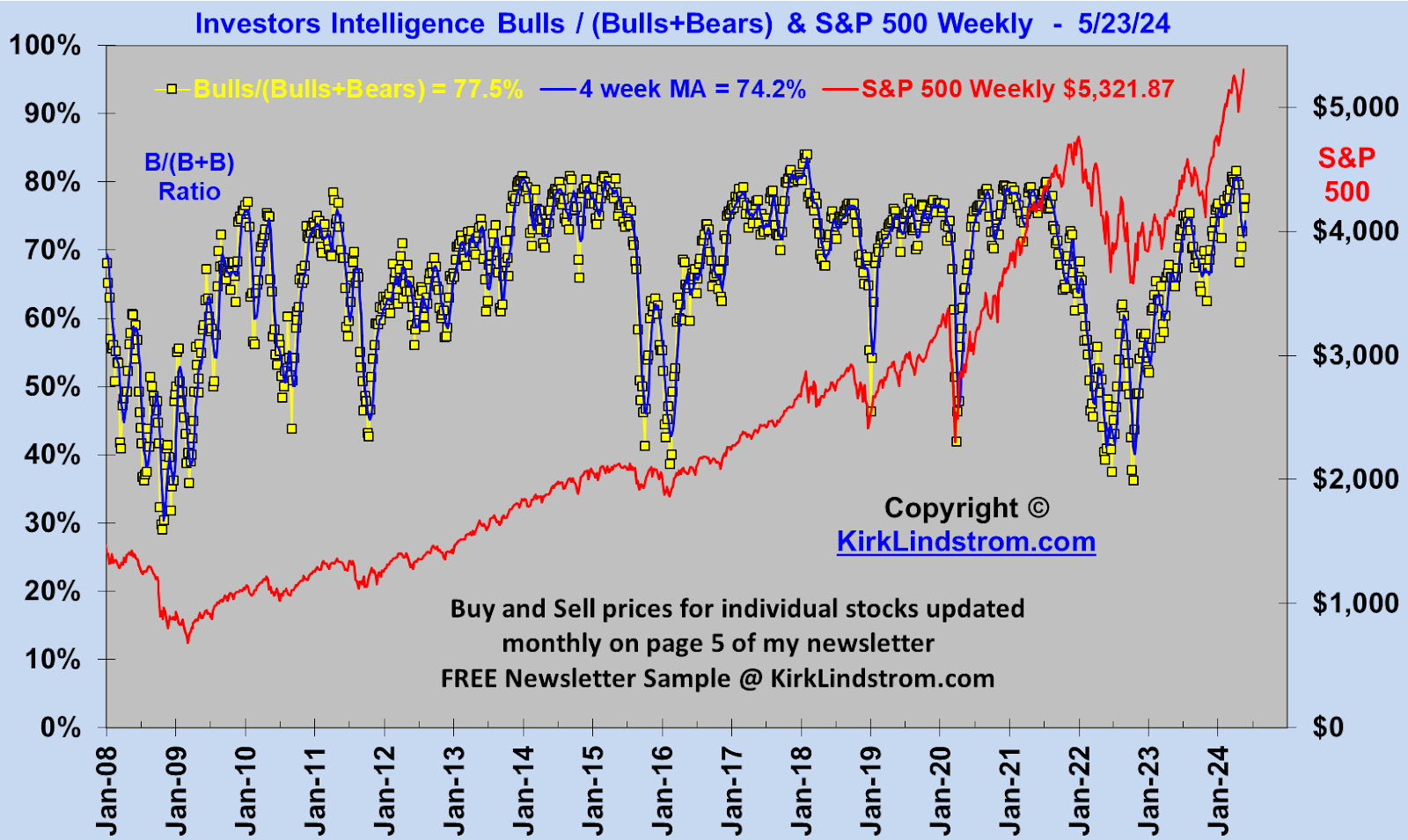

Investors Intelligence Bulls / (Bulls+Bears) & S&P 500 Weekly - 5/23/24

- The NAAIM Exposure Index represents the average exposure to US Equity markets reported by our members.

- https://naaim.org/programs/naaim-exposure-index/

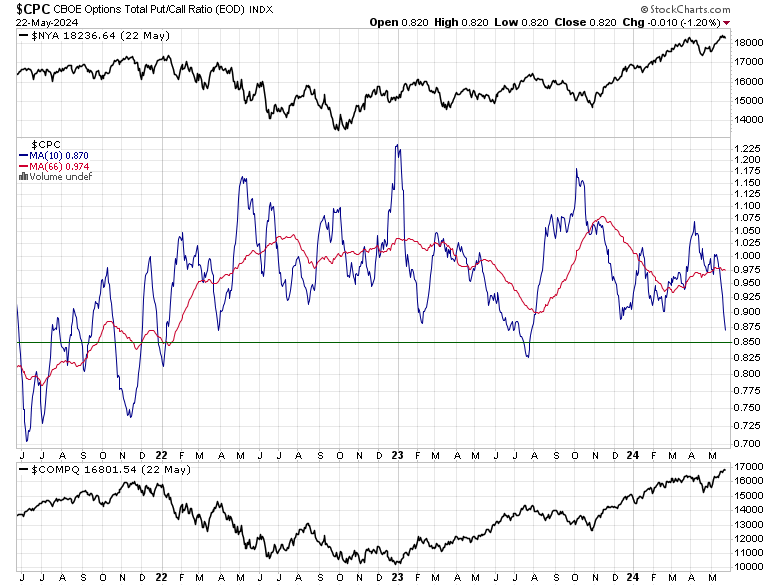

Invented by Tom Drake, the 2CS-p is the "5 day moving average of the product of the vix and p/c ratio." The scale runs from 0 to 100% with 0% max bullishness and 100% max bearish reading for us contrarians.

- Page 6 is dedicated to a monthly update on sentiment.

- Page 12 summarizes sentiment and how it relates to five other "Market Factors" I follow.

the May 2023 Issue for FREE!!!

This is not an “exact

science” so “all or nothing” market timing is foolish.

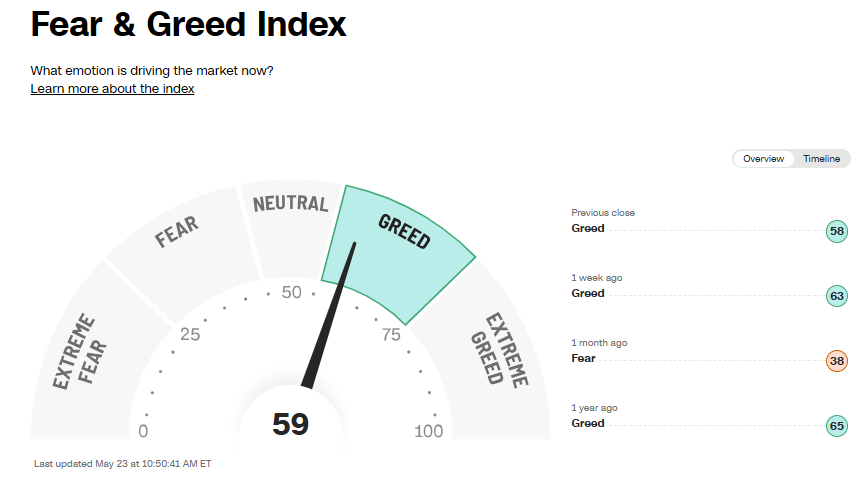

Market Timing Disclaimer: No

sentiment indicator, or any indicator for that matter, is 100% reliable. I look

at sentiment as head winds and tail winds. When sentiment is terrible, then it

acts like a tail wind for your returns where you could see further declines,

but long term, it is best to be buying when most others are selling.

Likewise, if we see sentiment get too bullish, then I would consider lowering

my portfolio asset allocation. It seldom pays to be buying stocks when

EVERYONE is talking about stocks and how much money they are making at cocktail

parties.

In addition, I am not market timing

but for a small portion of my Explore Portfolio. I use market-timing

indicators to tell me it is a good time to buy so I can add to positions when

the market is down and thus help me overcome my fear to rebalance back to my

target asset allocation. Likewise, when the market-timing indicators are

saying to sell, they usually come when the markets are high where I want to be

taking profits. The market timing indicators at market highs help me get

over my greed and take profits.