As of Friday's close, the Nasdaq and Russell 2000 small cap indexes remain in bear markets while the S&P 500 and DJIA have rallied off bear market lows back into "correction" territory.

S&P 500 Components YTD by Market Cap

(bigger boxes have bigger market caps)

(bigger boxes have bigger market caps)

Central banks raised short term interest rates to try and tame soaring inflation (9.1% for the US in June!) The 10-year Treasury yields have also risen:

10-year yields vs time for the US, the UK, Japan & Germany

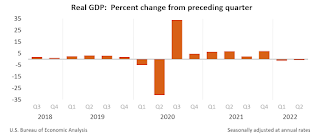

With negative GDP in Q1 and Q2 of 2022, was the first half of 2022 a mild, "technical recession?" See what others say about this question on my Facebook "Investing for the Long Term" Facebook group.

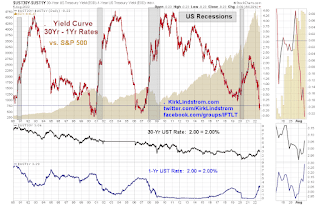

The 30-year to 1-year yield curve suggests we might have a recession in the future:

|

| US Treasury Yield Curve for 30-Yr minus 1-Yr rates |

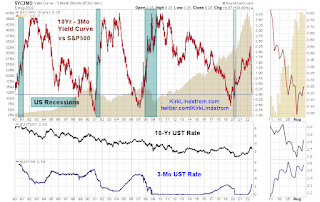

and the 10-yr to 3-month is getting close to giving that signal:

|

| US Treasury Yield Curve for 10-Yr minus 3-Mo rates vs. S&P 500 |

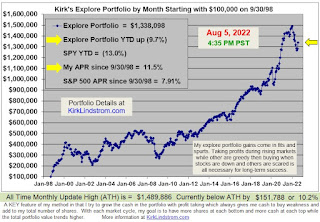

Kirk Lindstrom's Investment Letter

Subscribe NOW and get

the August 2022 Issue for FREE!!!

(If you mention this ad)

the August 2022 Issue for FREE!!!

(If you mention this ad)

More Articles by Kirk Lindstrom:

No comments:

Post a Comment