Kirk's 6/12/24 Deficit Spending Update: For FY 2024 to date, total taxes and other revenues collected YTD are up 9.8% year-over-year. The "good news" is SPENDING grew at "only" 8.0%! This means the deficit is growing a "slower rate."

The problem is during periods of economic growth like we've had for several years, we should be paying down debt by keeping spending below revenue, but we're doing the opposite.

After rising 10.3% in April 2024 vs April 2023, US Treasury revenue grew another 9.8% in May 2024 compared with May 2023. The trouble is spending grew at 8.0% and remains well above revenue. Summary

Stated as a household budget by dividing by 40,000,000:

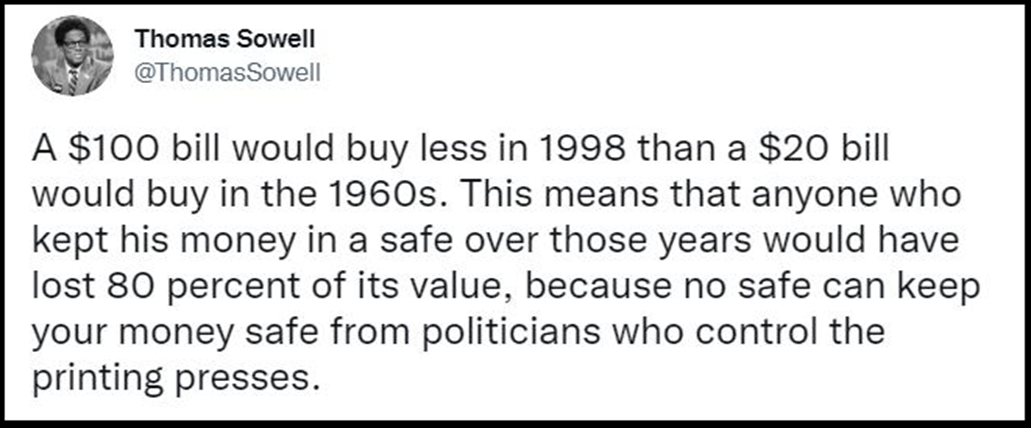

Inflation is a lazy government's way to raise taxes by pushing us into higher tax brackets while the spenders use borrowed money to buy vote for reelection without regard for what is good for the country. Understanding this data is KEY but few take the time to bother.

Kirk Lindstrom's Investment Letter: To see what stocks and ETFs are in my "Explore Portfolio" and get a full list of on my price targets to both take profits or buy more:

the June 2023 Issue for FREE!!!