On 9/5/2017 5:16 PM, RH wrote:

Hi Kirk;

The market really looks like it tanked today, right?

OMG, I never really know what to do with next step……I try to answer all emails, even if they don't have a specific question as I see part of my "service" is to reassure subscribers when they are worried.

Here is part of my reply (removing some personal details for this "edited" reply.)

Remember, one reason we took so many profits and diversified from US stocks that were way up to add to international stocks and build cash is the market often goes down. You have a LOT of cash now (50:50 conservative asset allocation) so if the market goes down by 10 or 20%, then you could put some of it to work buying stocks at sale prices.

With:

yet the stock market was only off about 3% at the low! Stocks like Finisar and GE really suffered but others that investors love, including Emerging markets (VWO) that we recently bought at much lower prices, continue to do well.

- an H-bomb tested by the nut in N. Korea plus

- Hurricane Harvey left hundreds of thousands with huge storm damage in Texas

- Hurricane Irma is heading towards Florida and it could be even bigger

- Tropical storm Jose is following Irma and could hit either areas just as they start to recover.....

So... remember that your asset allocation is much better now even with the stock market near record highs! You've done the work to be ready for a big decline.... yet if the market continues to chug higher, you have enough in to do really well too!On 9/6/2017 10:24 AM, RH wrote:

You somehow know me well and give me peace of mind.

Nobody likes to see stocks they own go down but with proper asset allocation and diversification, big declines are great opportunities to increase your overall market return.Thank you ever so much.

Lets say you retire with a $1,000,000 investment portfolio. To sleep well at night you put half into fixed income and half into stocks according to my "Conservative Core Portfolio." If the stock market drops 50%, which is has twice since the year 2000, then you would have roughly $750,000 and probably more because your fixed income on the conservative side of the portfolio would continue higher and your stock portfolio (ETFs or individual stocks) would continue to pay dividends.

I'd use the 50% bear market to significantly add stocks to my Explore Portfolio (as I did during both bear markets.) I would also do a MINIMUM of one portfolio reallocation from fixed income to stocks at the end of the year if stocks were still down just as last January I moved a great deal of cash out of markets that were way up in the Core Portfolios to fixed income to lock in gains.

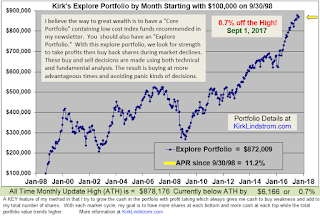

If you need references to verify I took profits when the markets were up and bought when they were down to get the returns I post, then I am happy to provide them. It blows me away that so many sell their newsletter services and don't provide simple return tables and graphs like I do below. That is a RED FLAG WARNING about what they sell.

Kirk Lindstrom's Investment Letter

Subscribe NOW and get the September 2017 Issue for FREE!!!

(Your 1 year, 12 issue subscription with SPECIAL ALERT emails will start with November issue.)

VWO Today

No comments:

Post a Comment