Happy New Year!

Unlike 2022, 2023 was a great year for both stocks and bonds.

- Despite very confident predictions from many famous economists that the US economy would experience a recession by Mid to Late 2023, this prediction was as bad as the prediction that high inflation would be "transitory."

- Prediction is very difficult, especially if it's about the future!”

Niels Bohr, Nobel laureate in physics & father of the atomic model - CPI-U Inflation fell by over 50% from 6.5% on December 2022 to 3.1% today. (Inflation peaked at 9.1% in June 2022. Note, inflation numbers are for the prior month.) Here we are a year and a half since inflation was thought to be "transitory" and yet it remains more than 50% above the Fed's 2.0% target.

- The 10-year US Treasury rate ended the year 0.1% below where it began. The 1-month US Treasury Rate rose from 4.12% to 5.60% today as the Federal Reserve raised their Fed Funds interest rate by 1.0%.

My Notes on the Fed Funds Rate

- 12/14/22 the Fed raised the Fed Funds rate by 0.50% to a new range of 4.25% to 4.50%

- 12/13/23 the Fed kept rates at a range of 5.25% to 5.50%

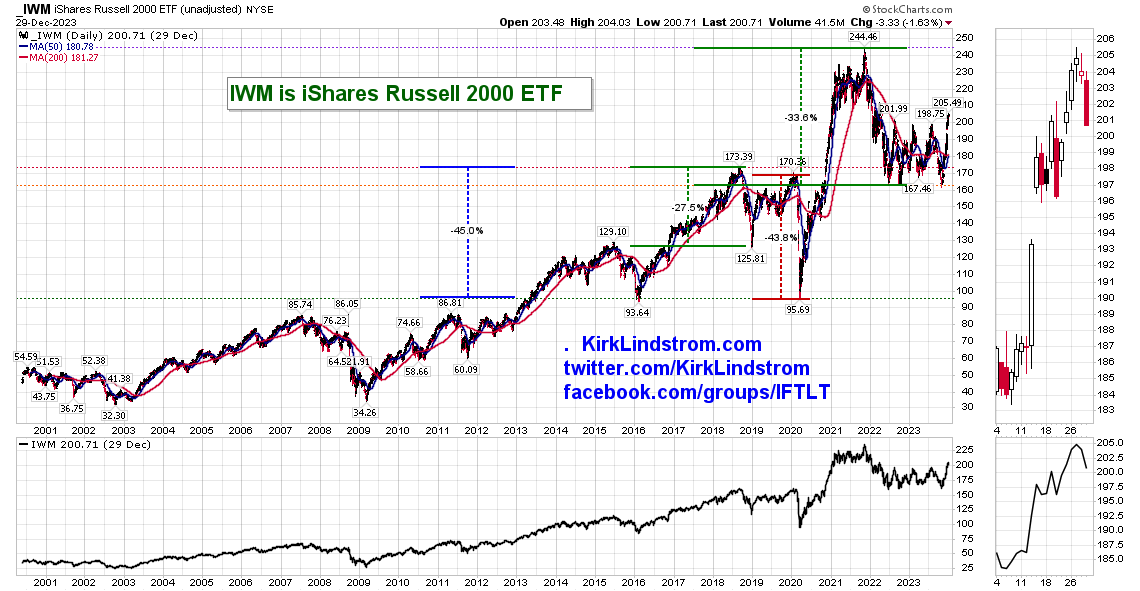

Major Market Index Charts:

S&P 500Kirk Lindstrom's Investment Letter

To see what stocks and ETFs are in my "Explore Portfolio" and get a full list of on my price targets to both take profits or buy more:

Subscribe NOW and get

the December 2023 Issue for FREE!!!

xx