As of Friday's close, the Nasdaq and Russell 2000 small cap indexes remain in bear markets while the S&P 500 and DJIA have rallied off bear market lows back into "correction" territory.

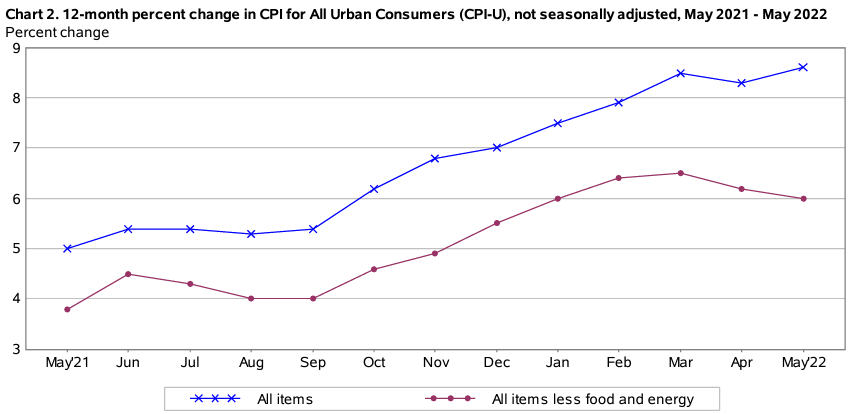

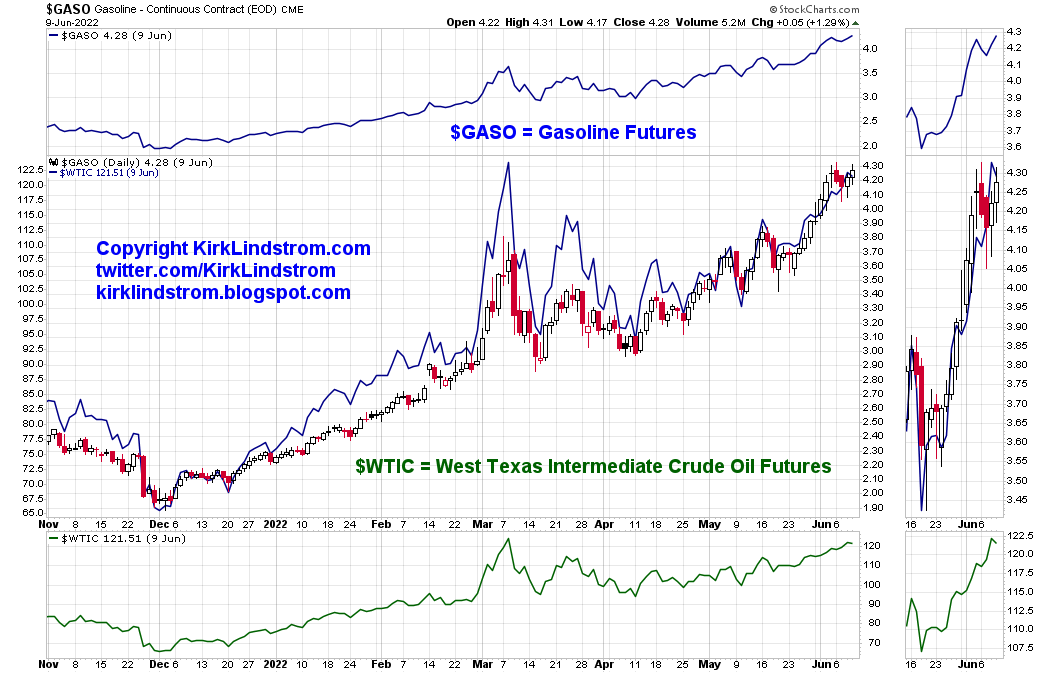

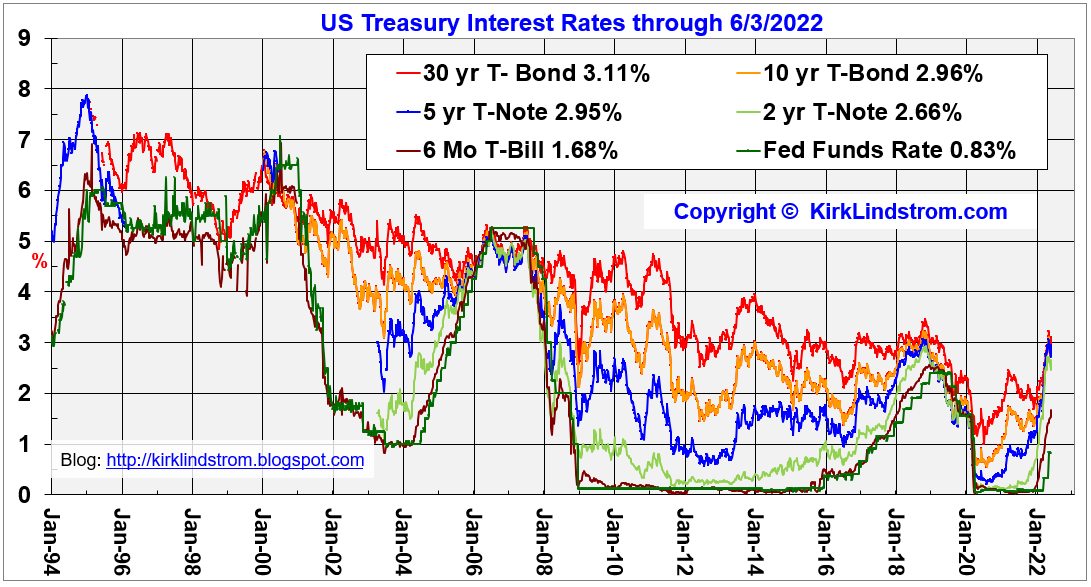

CPI & Expected Inflation Rate vs Fed Funds Rate

In my newsletter, I recommend one of two "core" portfolios for about 80 to 95% of your funds and an "explore" portfolio made of stocks from my newsletter "explore portfolio" for the remainder.

My newsletter stocks are volatile by design to add to overall returns with a combination of exceptional stock selection and market timing. You need a good core portfolio to sleep well at night.

I offer different core portfolios for aggressive & conservative investors. I use the same funds for both so you can transition from aggressive to conservative as you age and lower risk for a safe and happy retirement.

If you are not interested in individual stocks, then just follow one of my two core portfolios for 100% of your investment assets. One portfolio is for "conservative" investors and the other is for "Aggressive" investors. They use the same funds, but with different percentages so you can easily move from aggressive to conservative as you age or have success and want to lock in nice gains to retire early.

I believe pages 1 through 10 of my monthly investment letter offer more value than many "mutual fund" newsletters costing much more. If you are not interested in individual stocks or securities, then simply follow one of the core portfolios I recommend on page two, use the "Fixed Income and Interest Rates" update on page eight to help manage your cash, then consider pages 11 through 29 about individual securities as "entertainment."\

Kirk Lindstrom's Investment Letter

the June 2022 Issue for FREE!!!