One of my "Explore Portfolio" speculation stocks, NanoViricides (My charts at NNVC), is soaring again shortly after adding shares last year at $4.60 as part of my "year end tax loss selling play" where I try to buy or add to positions in stocks I think are making relative bottoms due to tax loss sellers, even those with short term losses.

|

| NNVC Intraday Chart - Click for Full Size Image |

For example, last year NNVC was the biggest gainer in my newsletter "Explore Portfolio" with a total gain for the year of 191.8%. You might ask "why would a stock that nearly tripled have people selling it for a loss?"

The answer is easy. Some jumped into the stock just after I took profits in my Explore portfolio at $7.25 before it came back to Earth. At $4.60, the stock was down 37% from where I took profits, a good pullback to add shares and a significant loss for those looking to offset gains in their other stocks.

|

| Recent Newsletter Trades for NNVC |

Smart traders with a short term loss who plan ahead were probably going to sell a month or more before the year ended, so I was there on November 21, 2013 to take some of their shares. They could then buy 31 days later at the end of the year when poor planners with short term losses would sell.

and get the January 2014 issue for free

(Start subscription with February issue)

Not-so-smart traders with short term losses who DID NOT plan ahead waited until later in the year to sell the stock and then they will buy back 31 days later to avoid the IRS "wash sale" rules.

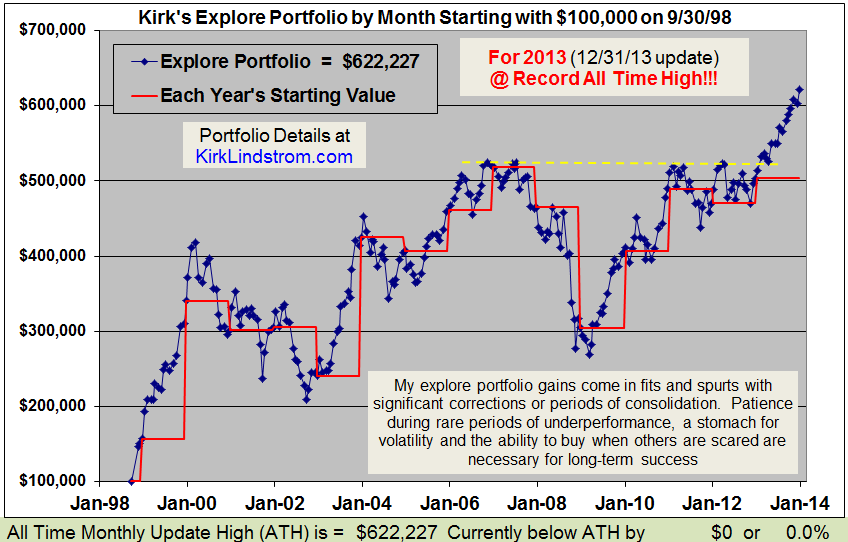

You can see on the top chart above that we got a better low for buying in November than in December, probably because the November tax-loss-sellers were buying shares back. Now we can enjoy the run and hit my next newsletter explore portfolio profit taking level, listed on page 5 of my January 2014 Investment Newsletter.

Don't Miss Out!

and get the January 2014 issue for free

(Start subscription with February issue)