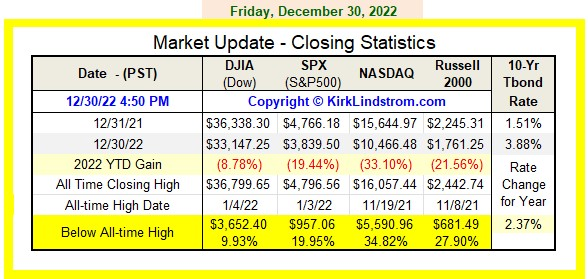

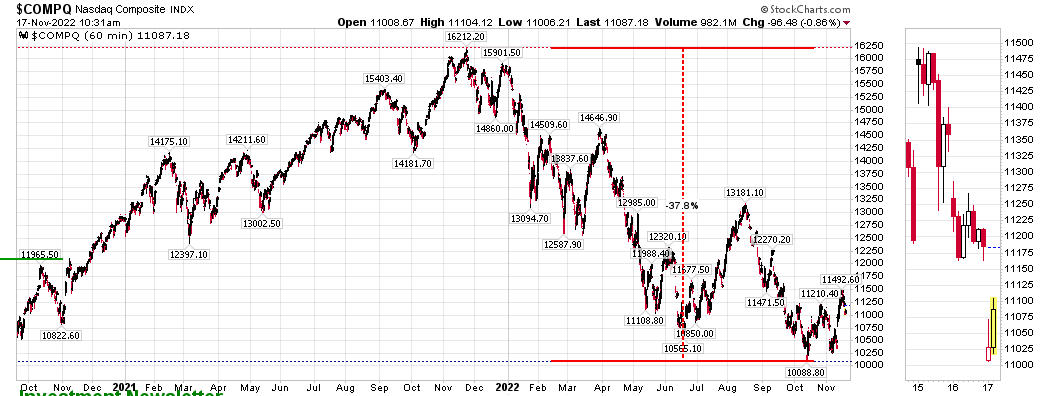

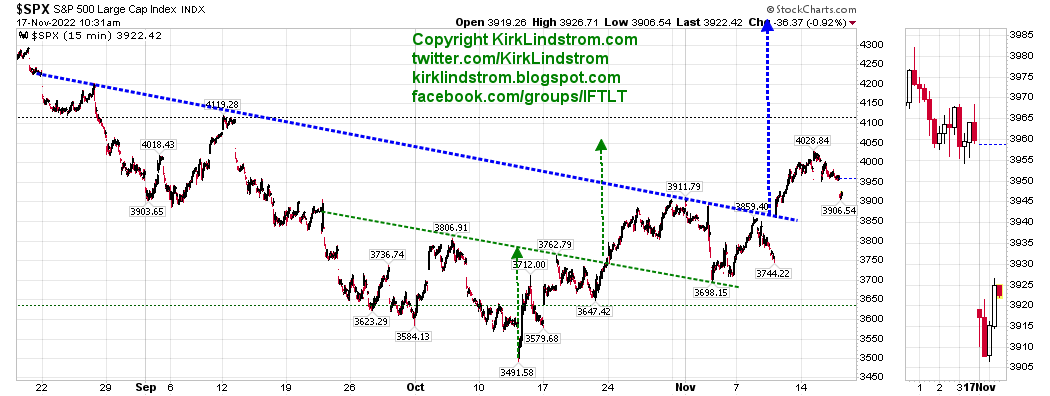

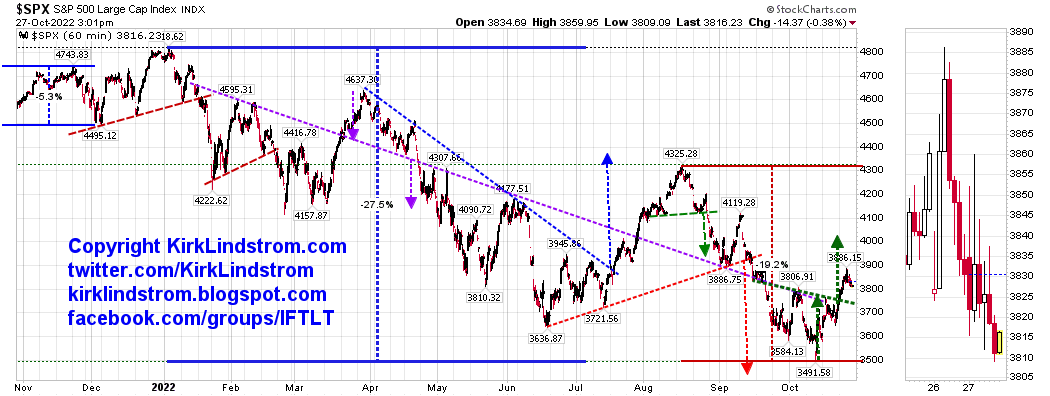

The S&P 500 index fell 19.44% in 2022 and ended the year down 19.55% from its record high set in early January 2022.

US Stock Markets YTD

With dividends included, the S&P 500 lost 18.2% using Vanguard's VFIAX "S&P 500 Index" Admiral Fund. US Small cap stocks did worse, causing Vanguard's VTSAX "Total Stock Market Admiral Fund" to lose 19.5% with dividends. After 20 years of significant outperformance, Vanguard's REIT (real estate investment trust) index fund, VGSLX, lost 26.2% which still beat the Nasdaq which lost 33.1% in 2022!

2022 was one of the worst years on record for 60:40 stock:bond investors in history since both went down. Here is a chart for illustration.

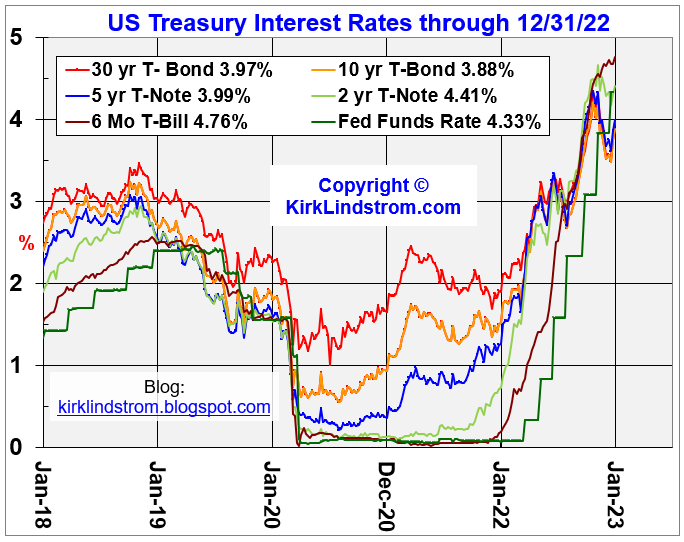

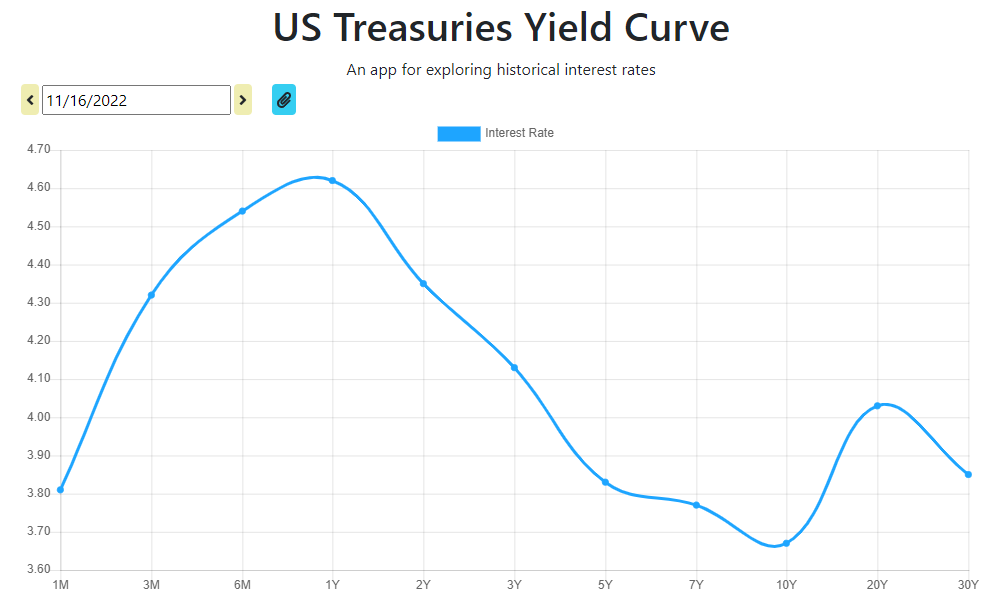

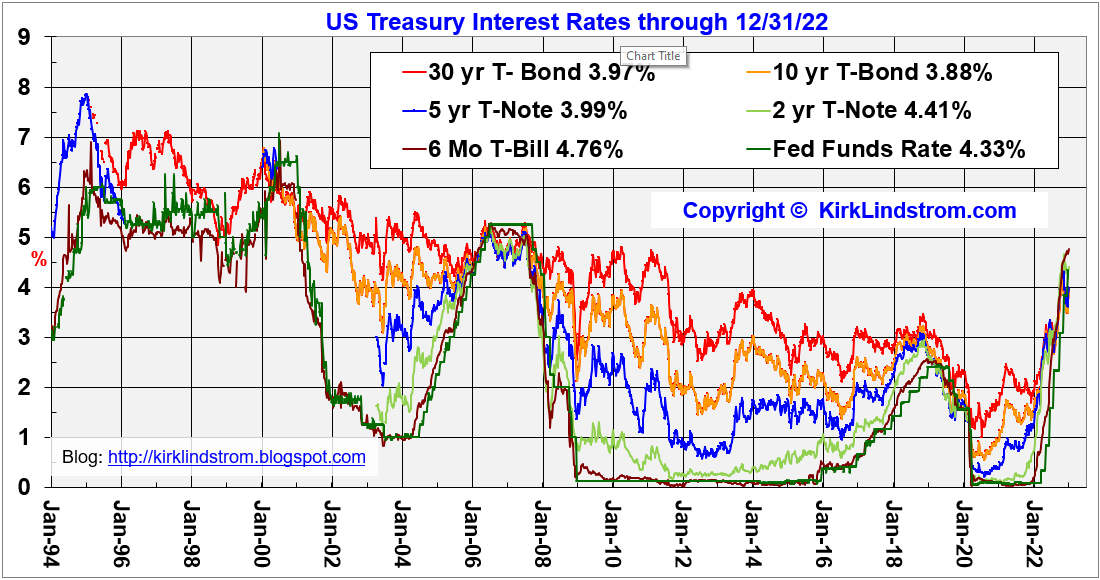

US interest rates soared this year as the Federal Reserved, late to the "inflation is not transitory" party, raised rates at a rapid pace which led to negative returns for both stocks and bonds.

US Treasury Rates through 12/31/22

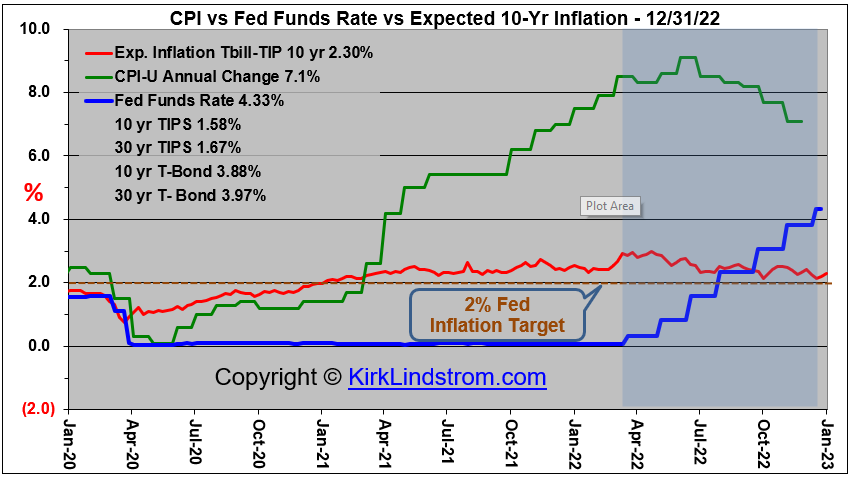

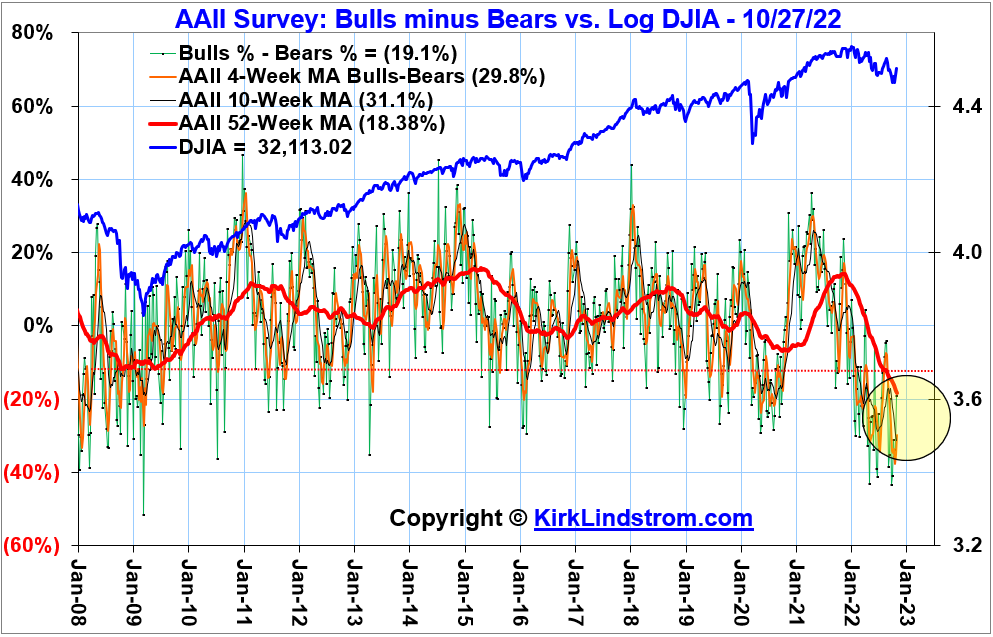

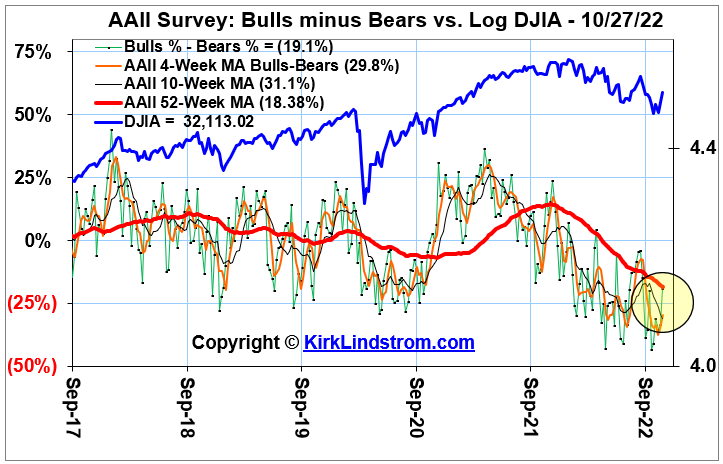

The good news is inflation as measured by annual changes in CPI-U has begun to fall. A big concern is will it fall fast enough to not get built into the economy and will the Fed engineer a "soft landing" which is lower inflation without causing a recession.

CPI vs Expected Inflation Rate

LIBOR Rates from 1993 to 12/31/22

My "Newsletter Explore Portfolio" had a good year beating the S&P 500 by 5.5% but it still suffered a decline as I don't believe in trying to jump in and out of the market. I trade around core positions in my stocks (using buy and sell prices listed ahead of time on page 5 of my monthly newsletter) which does add to return and my large cash position buffers the portfolio in down markets.

Kirk Lindstrom's Investment Letter

To see what stocks and ETFs are in my portfolio and get a full list of on my price targets to both take profits or buy more:

Subscribe NOW and get

the December 2022 Issue for FREE!!!

the December 2022 Issue for FREE!!!

|

| Subscribe NOW |