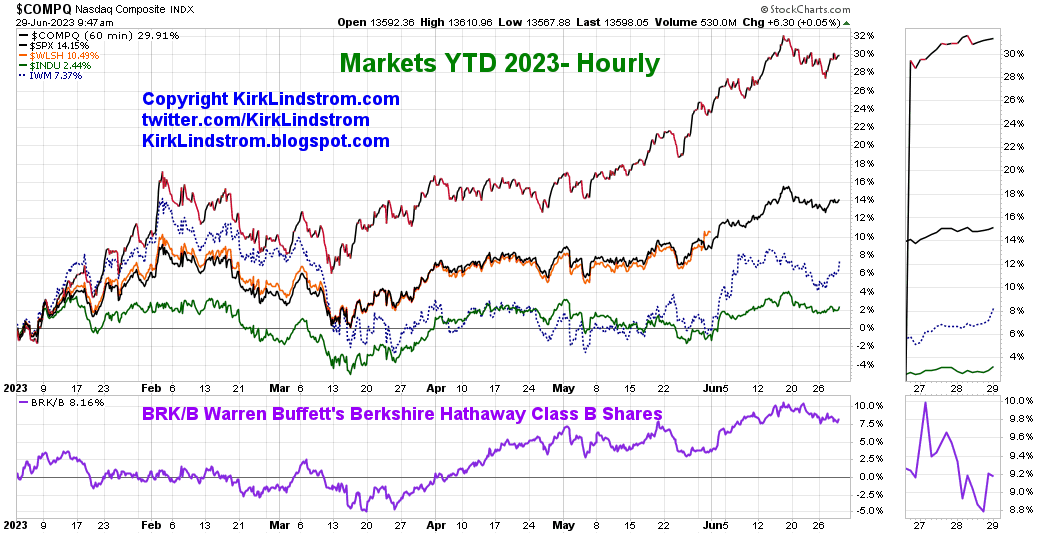

🐂📈Kirk Lindstrom's Investor Bull/Bear Sentiment Charts for 6/29/23 📉🐻

Reminder, you can subscribe or follow this feed and get sent emails by Google when I post new charts and articles. Just click "Follow" below.

II Investors Intelligence & AAII (American Association of Individual Investors) Sentiment Updates.

II Investors Intelligence & AAII (American Association of Individual Investors) Sentiment Updates.

Graphs best views full screen.

II Bulls and Bears Sentiment Graphs

AAII Bulls and Bears Sentiment Graphs: The AAII Investor Sentiment Survey measures the percentage of individual investors who are bullish, bearish, and neutral on the stock market for the next six months.

These charts are covered on page 6 of my newsletter with updates during the year for what the different types of sentiment charts mean to me. This is an easy place to give my subscribers updates of charts too numerous to add each month I cover.

To see what stocks and ETFs are in my "Explore Portfolio" and get a full list of on my price targets to both take profits or buy more:

Subscribe NOW and get

the June 2023 Issue for FREE!!!

(If you mention this ad)

the June 2023 Issue for FREE!!!

(If you mention this ad)