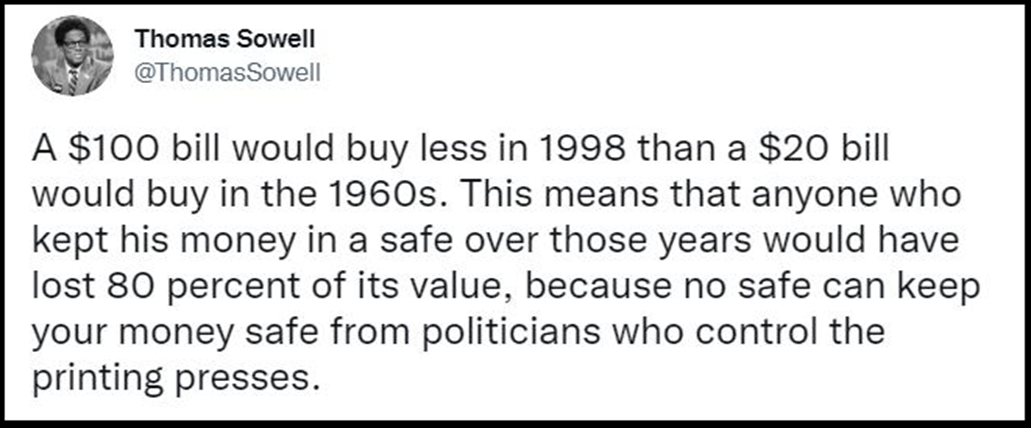

Despite President Biden's "Inflation Reduction Act of 2022" (estimated to contain $500B in new spending and tax credits) and the Federal Reserve keeping its Fed Funds Interest Rate at a 20-year high, inflation at 3.3% is 1.3% or 65% above the desired or "target rate" of 2.0%.

CPI-U: This morning the US Bureau of Labor Statistics announced, "The Consumer Price Index for All Urban Consumers (CPI-U) was flat in May on a seasonally adjusted basis, after rising 0.4 percent in April". and "Over the last 12 months, the all-items index increased 3.3 percent before seasonal adjustment."

Core CPI-U: "The index for all items less food and energy rose 0.2 percent in May, after rising 0.3 percent the preceding month" and "The all items less food and energy index rose 3.4 percent over the last 12 months."

Chart: CPI vs Fed Funds Rate vs Expected 10-Yr Inflation from 2004

Chart: CPI vs Fed Funds Rate vs Expected 10-Yr Inflation from 2020Table: Raw Inflation Data from November 2023:Kirk Lindstrom's Investment Letter: To see what stocks and ETFs are in my "Explore Portfolio" and get a full list of on my price targets to both take profits or buy more: