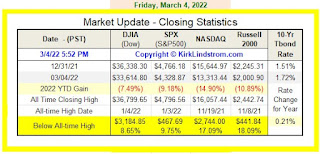

Market Update for the week ending 3/4/2022:

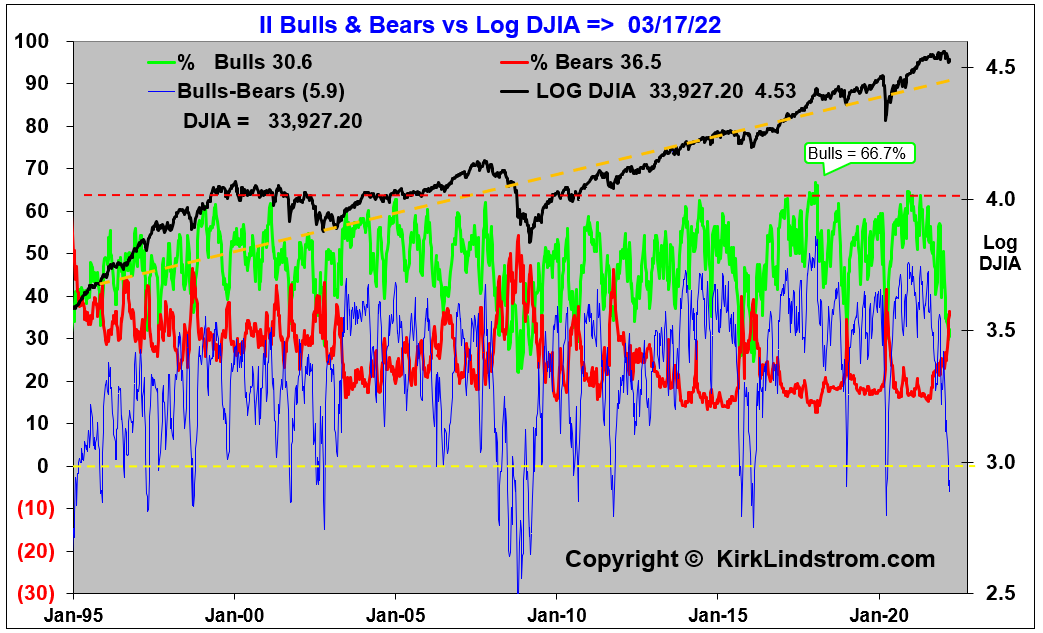

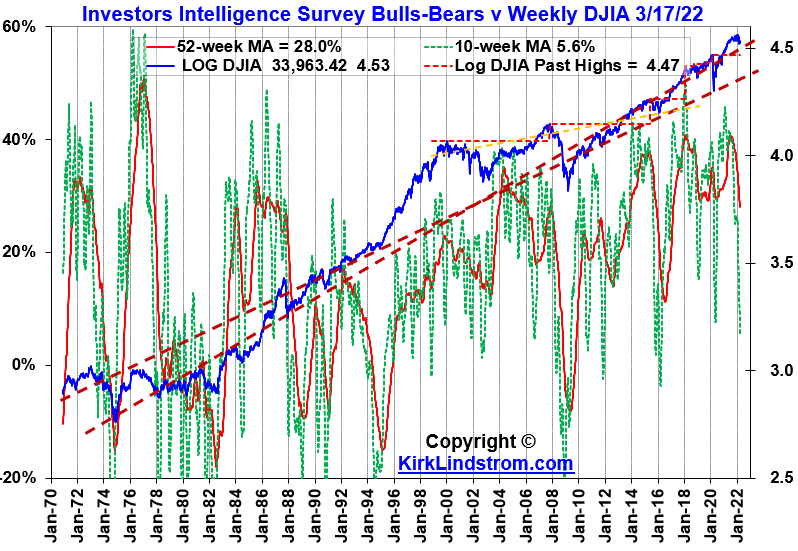

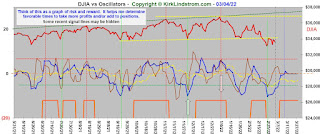

Kirk's Dow vs Oscillators Graphs

There is still a Head & Shoulder Top formation in this next DOW chart but the good news is the Dow is about halfway between the target price and the neckline. If it rallies above the neckline, then the target price and the pattern are no longer in play. Until this is taken out, caution is advised.

$SPX $COMPQ $RUT $INDU $SPY $DIA #StockMarket #Stocks #Investing #Sentiment (Note recent signals hidden) #DowVsOscillatorsChart

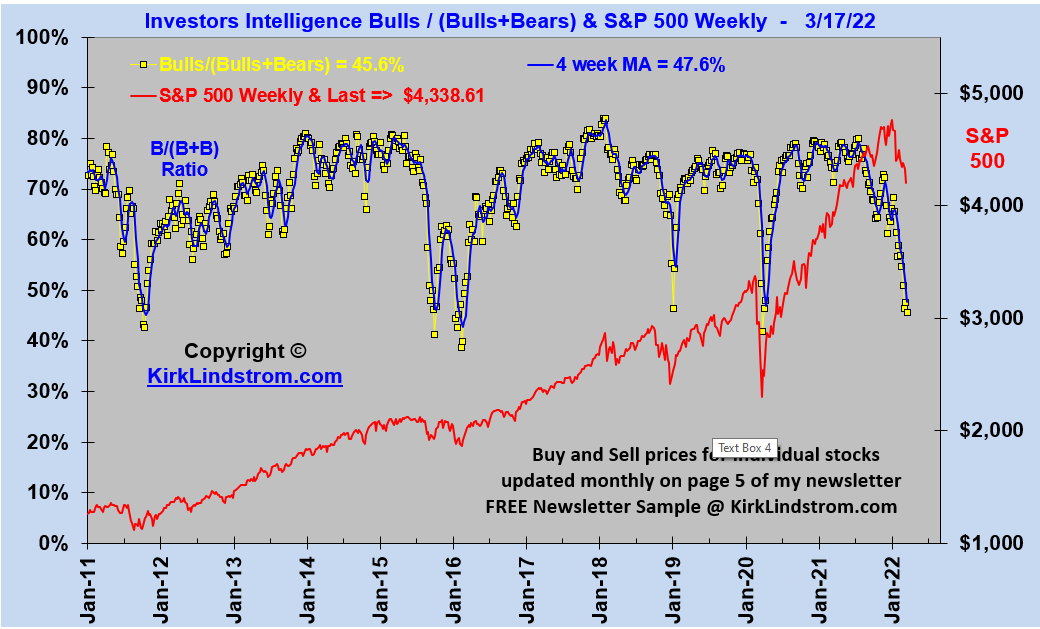

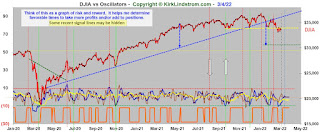

The good news is the more important S&P 500 SPX chart has ALREADY reached its two bearish Head and Shoulder top targets and it could be forming a shoulder for a bullish inverted head and shoulder bottom pattern which would commence with a rally above the dashed green line on this chart. Lets call it $4395 and falling.