🐂📈Kirk Lindstrom's Investor Bull/Bear Sentiment Charts for 3/23/23 📉🐻

Reminder, you can subscribe or follow this feed and get sent emails by Google when I post new charts and articles. Just click "Follow" below.

II Investors Intelligence & AAII (American Association of Individual Investors) Sentiment Updates

II Investors Intelligence & AAII (American Association of Individual Investors) Sentiment Updates

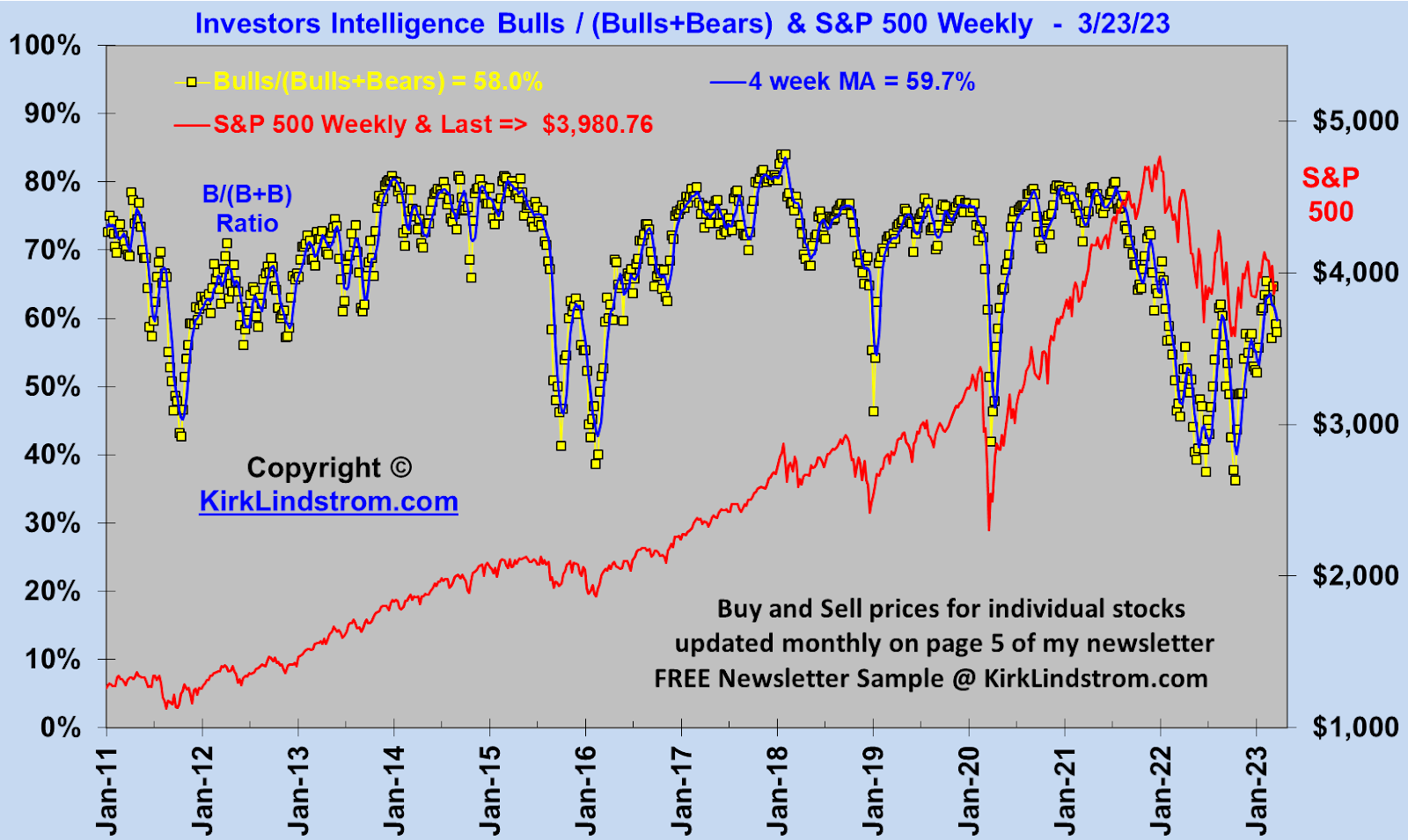

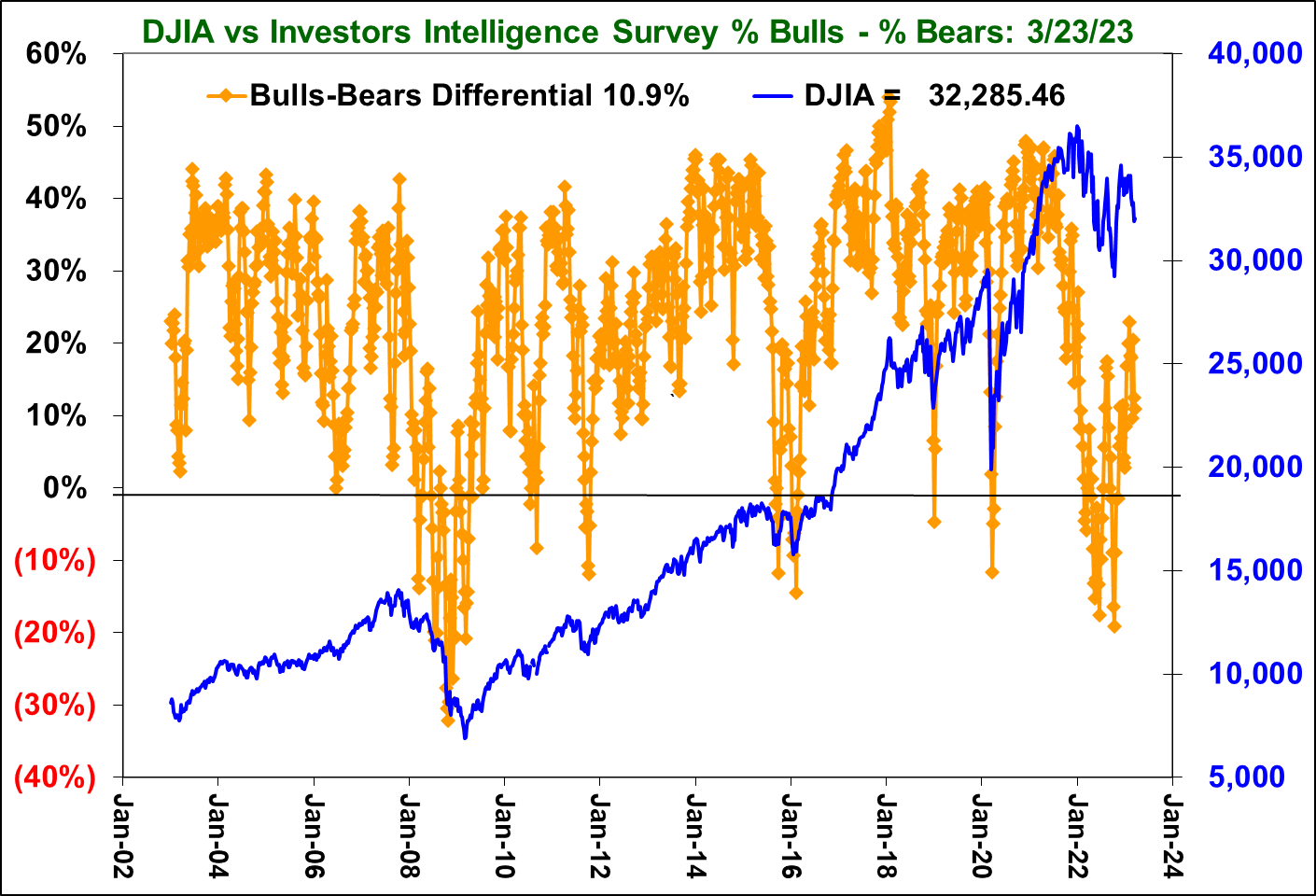

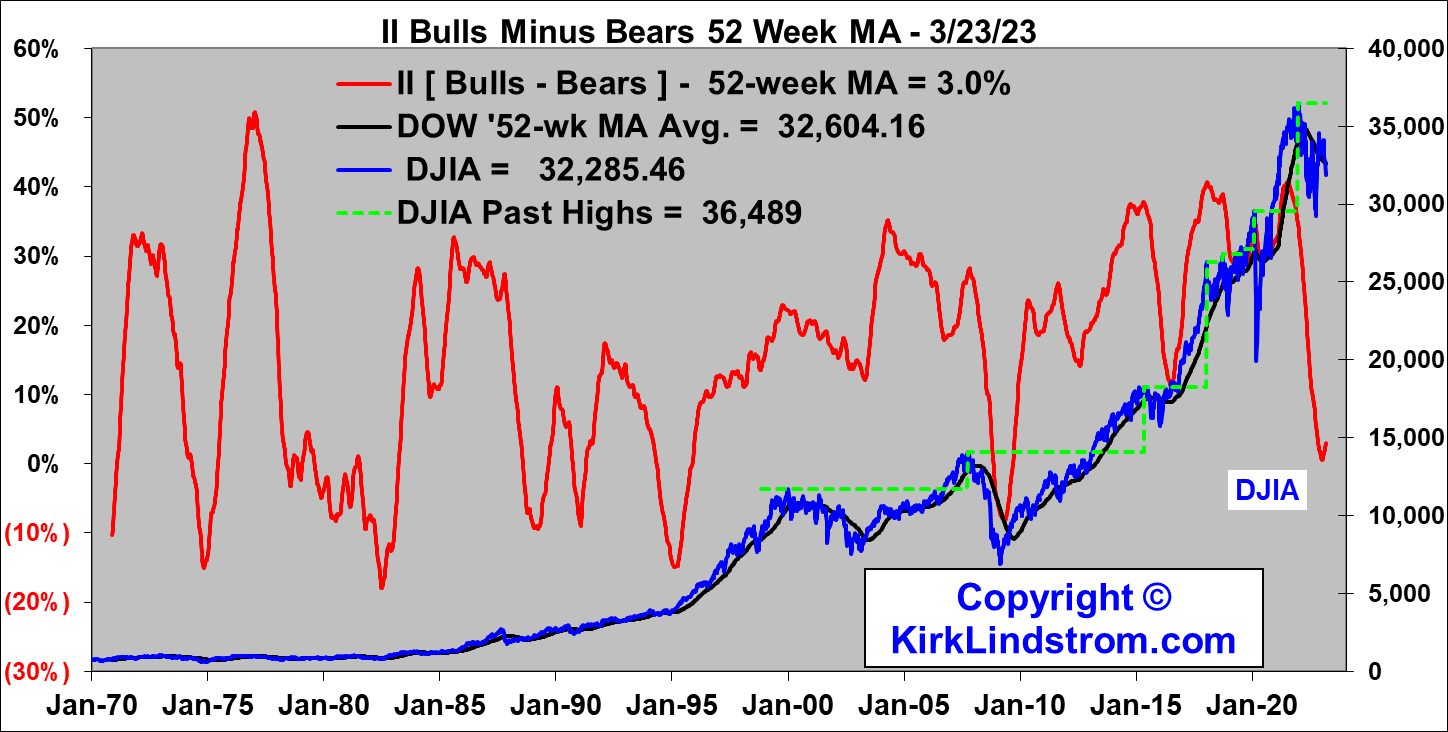

II Bulls and Bears Sentiment Graphs

- % Bulls = 39.7

- % Bears = 28.8

- % Bulls minus % Bears = 10.9%

- % Bulls / (% Bulls +% Bears) = 58.0

Click charts to view full size

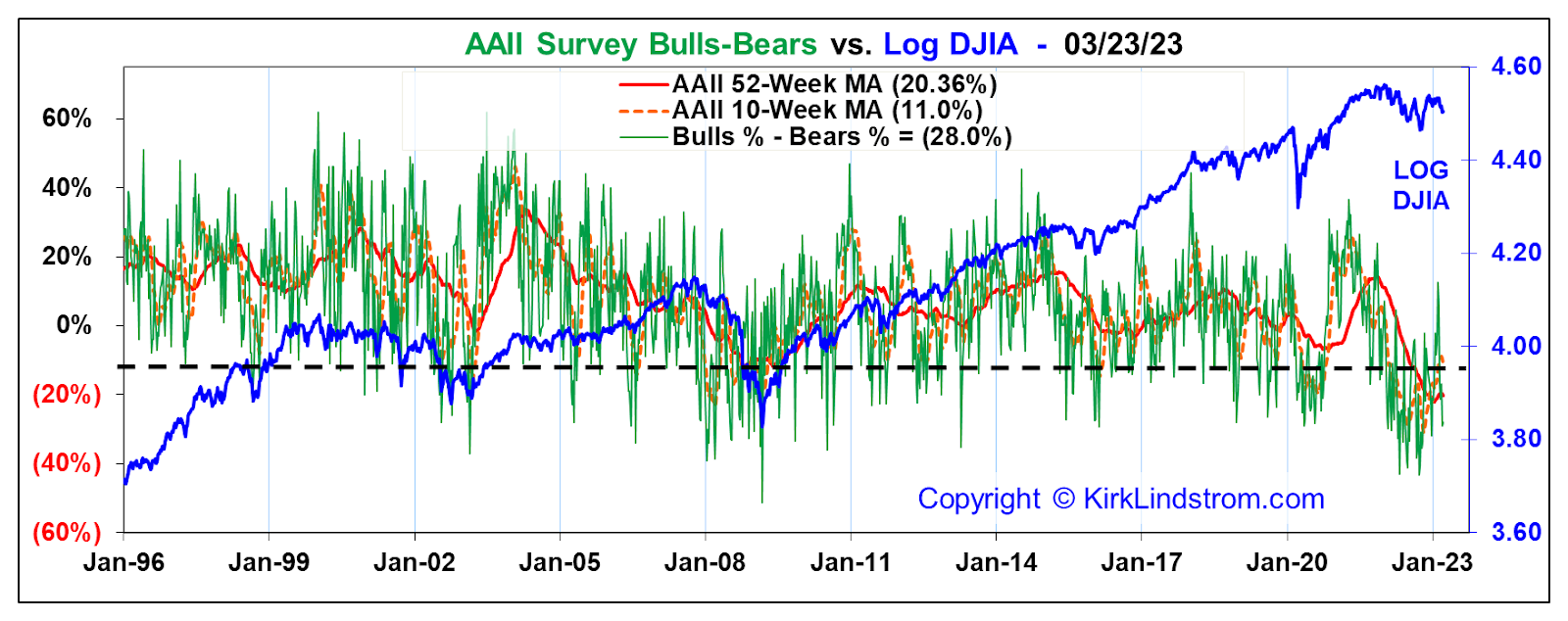

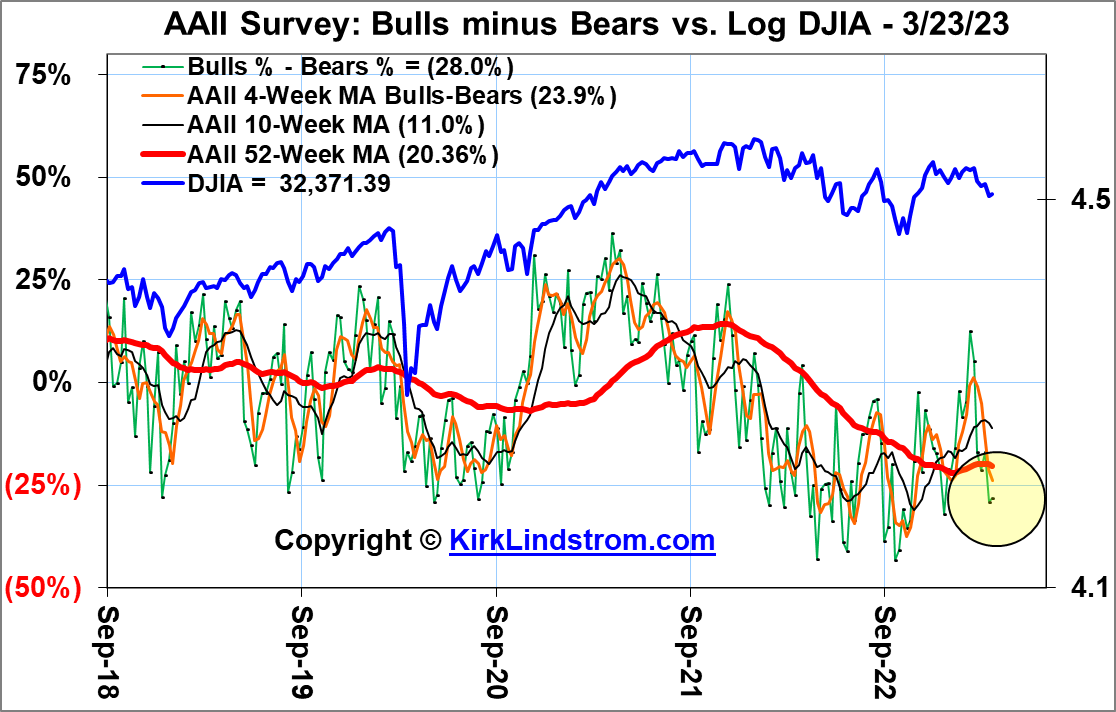

AAII Bulls and Bears Sentiment Graphs: The AAII Investor Sentiment Survey measures the percentage of individual investors who are bullish, bearish, and neutral on the stock market for the next six months.

As of 3/23/23, the AAII members are:

More: Bradley Turn Dates for First Half of 2023

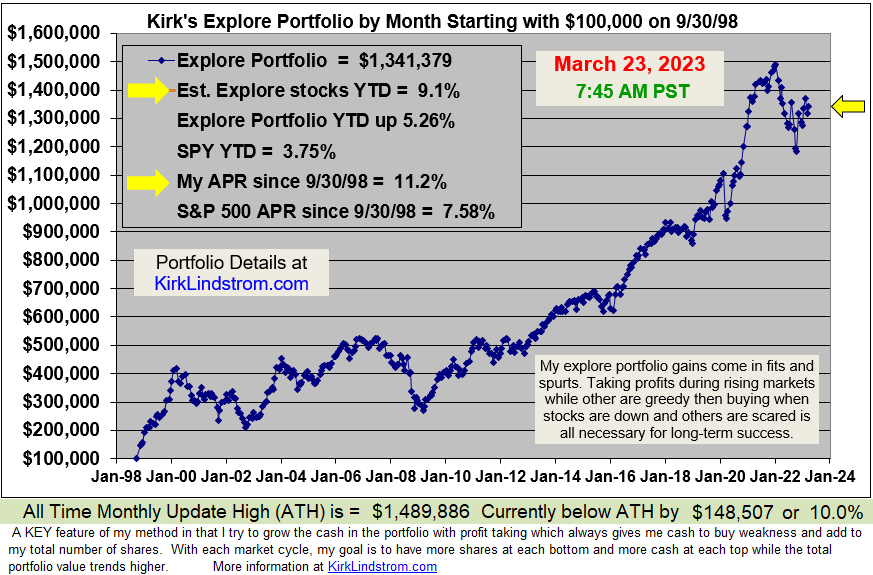

Kirk Lindstrom's Investment Letter

To see what stocks and ETFs are in my "Explore Portfolio" and get a full list of on my price targets to both take profits or buy more:

Subscribe NOW and get

the March 2023 Issue for FREE!!!

(If you mention this ad)

the March 2023 Issue for FREE!!!

(If you mention this ad)

Reminder, you can subscribe to this feed for free to get sent emails by Google when I post new charts and articles. Just click "Follow" below.