We need to make an effort to help them get through this. Follow and "Like" the Milk Pail Facebook page to get coupons and to show your support.

Here are some pictures I took today from the Milk Pail's parking lot along with a rendering of what will go in the open space that was between the Milk Pail market and the super ugly, $4,000 to $6,000 per month "Carmel The Village Apartments" where the owners make a bundle on rent while we suffer the traffic gridlock on San Antonio Road.

|

| Best viewed in Full Screen |

|

| Best viewed in Full Screen |

You are not alone if you feel like a sardine in what was once a beautiful place to live. What we need to do is

- Support local businesses like The Milk Pail

- Voice our displeasure with the over development at EVERY opportunity.

- Write your city council

- Post on facebook and Twitter pages for anything related to city government letting them know how upset you are with this over development

- Start a petition to change the name of "Mountain View" to "Brooklyn West" to reflect we are losing our views of the beautiful mountains so the top 0.1% who own these tech companies can cram more workers into their buildings so they can live here rather than places with lower density and less environmental impact from too many people.

It is AMAZING how big the hole is... it looks like the space will hold enough workers to fill all the homes in Los Altos. I may have to bite the bullet and buy Amazon.com stock despite its over valuation as driving to go shopping won't be fun.

|

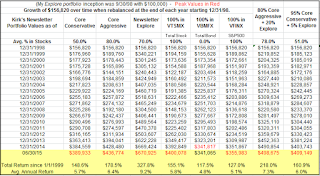

| Rent and Layout for 2b/2b "Carmel The Village" as of 12/21/15 |