David Archibald discusses the Four Great Global Challenges

On Tuesday, 28 February, Mr. David Archibald - an Australian-based climate scientist and oil exploration expert - delivered a two-part guest presentation at the Institute entitled "The Four Horsemen of the Apocalypse." It is interesting that he says we will face a global COOLING cycle due to reduced sum spots.

Mr. Archibald - who has been recognized as "the first to realize that the length of the previous sunspot cycle (PSCL) has a predictive power for the temperature in the next sunspot cycle" - also argued that the warming of the last 150 years will be reversed as the Earth's temperature begins to cool sharply due to lower solar activity. Global cooling may well jeopardize grain production and threaten potential famines, which will certainly impact significantly the international situation. Below are excerpts from The Institute of World Politics.

The four horsemen, i.e. great challenges the world will soon have to face, are:

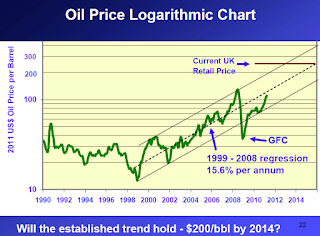

- a decreasing extraction of oil, causing growing prices of energy and, by extension, food;

- Pakistan's nuclear weapons program, which threatens proliferation and, perhaps, even a nuclear war in the region;

- rapid population growth in the Middle East and North Africa coupled with higher food imports in those regions, which spells mass starvation; and

- a 210-year climate cooling cycle.

Mr. Archibald suggests a three-pronged solution to tackle the energy crisis:

- replacing declining oil production with coal liquefaction and compressed natural gas for automotive use;

- employing nuclear power, rather than coal, for electric power generation; and

- developing much safer thorium reactors to replace uranium in nuclear energy.

To view Mr. Archibald's slideshow in its entirety, please see:

- Four Horsemen of the Apocalypse Part 1 - Conquest and War

- Four Horsemen of the Apocalypse Part 2 - Famine and Death

Long Term Results that Speak for Themselves

Since 9/30/98 inception, "Kirk's Newsletter Explore Portfolio" is UP 390%vs. the S&P500 UP only 51% vs. NASDAQ UP only 57% (All through 12/31/11)

Subscribe NOW and get the April 2012 Issue for FREE! !

(More Info, Testimonials & Portfolio Returns)

Latest 2012 Update: Up 11.3% YTD as of 3/31/12

(remember this 2012 performance is with 1/3 in fixed income!)

IBD Confirmed uptrend

ReplyDeleteHowever, it wasn't the Nasdaq that confirmed the market's new uptrend. That feat came courtesy of the S&P 500.

The large-cap index made a follow-through as it rallied 1.4% on the 11th session of a new rally attempt. It had posted a near-term low on April 10. On Monday, the 500 got smacked hard, falling as much as 1.4%, but it didn't undercut the April 10 low of 1357.38

Definitions - IBD Follow-through Day