AAII Bulls Minus Bears vs DJIA and "Irrational Exuberance & Pessimism" Investor Sentiment Graph for 8/22/18:

The AAII Investor Sentiment Survey measures the percentage of individual investors who are bullish, bearish, and neutral on the stock market for the next six months. AAII is the "American Association of Individual Investors." For the survey, Individual members of the AAII are polled on a weekly basis. Only one vote per member is accepted in each weekly voting period. The AAII reports the weekly results at https://www.aaii.com/sentimentsurvey/.

As of 8/22/18, the AAII members are:

- Bullish: 38.46%

- Neutral: 34.47%

- Bearish: 27.07%

AAII Bulls vs Bears Investor Sentiment "Irrational Exuberance & Pessimism" Graph

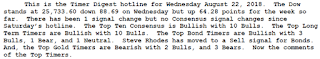

Timer Digest Update:

More about Timer Digest: "Timer Digest monitors over 100 of the leading market timing models, ranking the top stock, bond, and gold timing according to the performance of their recommendations over various periods of time. Timer Digest profiles many of the Top Investment and Financial Newsletter writers, including discussions of their timing models."

To get my "Special Email Alerts" and the "Auto Buy Sell Table" where I list ahead of time what stocks I will buy at what prices during declines and what I will sell during the advances. These buys and sells are at preset target prices you can use to set limit orders at your broker.

Subscribe NOW and get

the August 2018 Issue for FREE!!!

the August 2018 Issue for FREE!!!

Charts of the AAII (American Association of Individual Investors) Bulls minus Bears Index versus the market are key sentiment indicators for stock market technical analysis. Contrarian theory states the time to buy is when fear and pessimism are at a maximum since this usually occurs near market bottoms.

More Information

- A contrarian is a person with a preference for taking a position opposed to that of the majority view prevalent in the group of which they are a part

- More about Technical Analysis & Sentiment Indicators

- Discuss on Facebook at Investing for the Long Term.

No comments:

Post a Comment