Unfortunately, the "Estimated Tax Payment" for the 2018 tax year that I (and others) sent in January 2019 to the US Treasury was not large enough to cause the surplus to grow compared to January 2018. Was the government shutdown to blame?

The Monthly Treasury Statement summarizes the financial activities of the federal government and off-budget federal entities and conforms to the Budget of the U.S. Government.

You can never have too much data so I process the latest reports to see tax collections, spending and the official deficit behaves without "noise" from the obviously biased MSM "Main Stream Media."

|

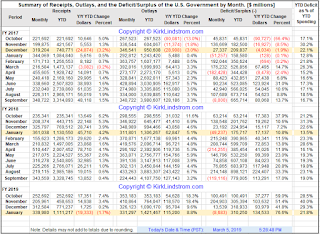

| Table 1 Summary of Receipts, Outlays, and the Deficit/Surplus of the U.S. Government by Month. [$ millions] |

- Taxes collected in January 2019 were lower than taxes collected in January 2018

- It is possible this decline is due to the government shutdown so we'll have to keep an eye on the data to see if it recovers now that the government is open for business again.

From the data in Table 2, you can clearly see:

The worst news is the deficit continues to grow at an alarming rate.

The good news is the US Stock Market, so far, doesn't seem to mind as long as interest rates remain relatively low and the Fed remains in a "holding pattern" where it does not raise the Fed Funds rate until we get by this "soft spot" in the US and global economy.

- Tax collections during the first four months of fiscal 2018 grew year over year and month over month over fiscal 2017 but

- after a good start in October of FY-2019 with monthly tax collection growth of 7.41%, tax collections have fallen on a monthly basis and

- tax collections on a year over year basis fell by 1.7%, the first decline since March of FY-2017 when they fell by 0.2%.

The worst news is the deficit continues to grow at an alarming rate.

The good news is the US Stock Market, so far, doesn't seem to mind as long as interest rates remain relatively low and the Fed remains in a "holding pattern" where it does not raise the Fed Funds rate until we get by this "soft spot" in the US and global economy.

Don't miss out!

NOTE: Due to the lapse in appropriation, the dates for publication of the Monthly Treasury Statement (MTS) for December, January, and February have changed. Here are the revised dates:

- December MTS – Publish on 2/13

- January MTS – Publish on 3/5

- February MTS – Publish on 3/22

- March MTS – On normal schedule

No comments:

Post a Comment