- Reports on Friday sad Venezuela's central bank had converted 1.4M oz. of its gold reserves into at least $1B in cash through a swap with Citibank.

- "That was a huge potential seller taken out of the market. It's not an overhang anymore," Dennis Gartman said on the Venezuela deal.

- Other gold watchers say the bigger factor driving prices was the expiration of May options and short covering; an increase of 13K shorts in the market is a positive since those traders could be forced to buy gold when they cover, says Kevin Grady of Phoenix Futures and Options.

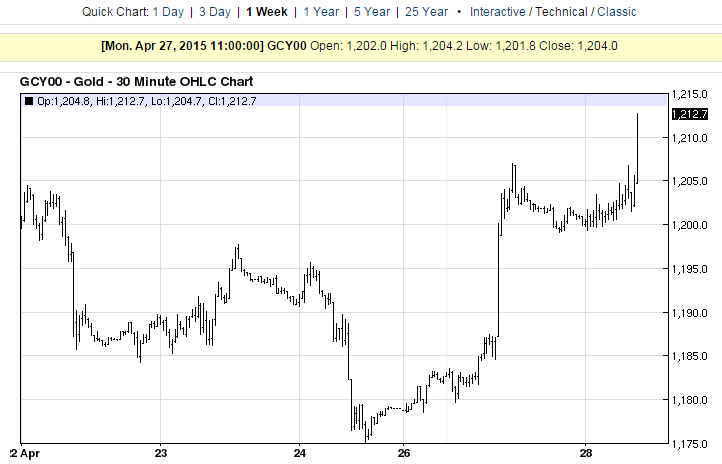

Today gold futures are higher again:

Gold testing a 15-year trend line:

Gold prices retraced the 61.8% Fibonacci level

Is the bottom in?

- Current Quote for the Price of Gold

- Gold and GLD Resistance and Support Levels

Three Key Charts to watch

Are you Long, neutral or short gold?

I have a gold trade in my newsletter.

- Subscribe NOW and get the April 2015 Issue for FREE!!!

No comments:

Post a Comment