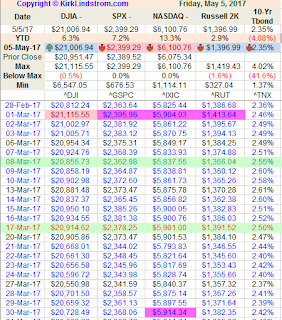

- The four major US markets I follow are up between 1.9% and 15.4% YTD.

- The S&P500 and Nasdaq markets set new record closing highs today!

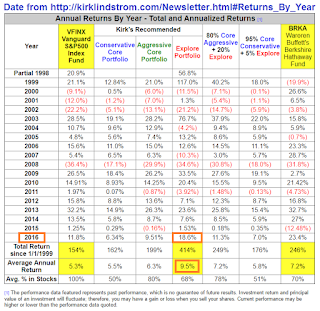

- My Explore Portfolio continues to do well in 2017 after a great 2016. It finished the week at a new record high! (see graph below)

- The New Rates for New and Old I-Bonds are out.

- Click images to see full size

This chart shows the data in tabular form.

If your own portfolios are not up somewhere between 1.85% and 15.36 YTD and you didn't get double digit gains last year, then you should consider what you are doing wrong and look to make changes, perhaps with the help of a subscription to my newsletter.

These charts show the Nasdaq and S&P500:

Long

Term Results that Speak for Themselves

Since 9/30/98 inception, "Kirk's Newsletter Explore Portfolio" is UP 758%

vs. the DJIA UP only 162%, S&P500 UP only 231% and NASDAQ UP only 267%

(All through 5/26/17)

Timer Digest Features Kirk Lindstrom's Investment Letter on its Cover

Since 9/30/98 inception, "Kirk's Newsletter Explore Portfolio" is UP 758%

vs. the DJIA UP only 162%, S&P500 UP only 231% and NASDAQ UP only 267%

(All through 5/26/17)

Timer Digest Features Kirk Lindstrom's Investment Letter on its Cover

- Subscribe

to my service NOW and get the May 2017 Issue for FREE! !

Your 1 year, 12 issue subscription will start with next month's issue. - Get email alerts when I buy or sell securities for my explore portfolio

- "Auto Buy" and "Auto

Sell" levels set ahead of time for target buy and sell

levels for my securities. This allows you to place

"limit orders" with your broker in advance so you can go

about your business.

- All questions about what I write answered by Email. If what I write is not clear to you, just ask!