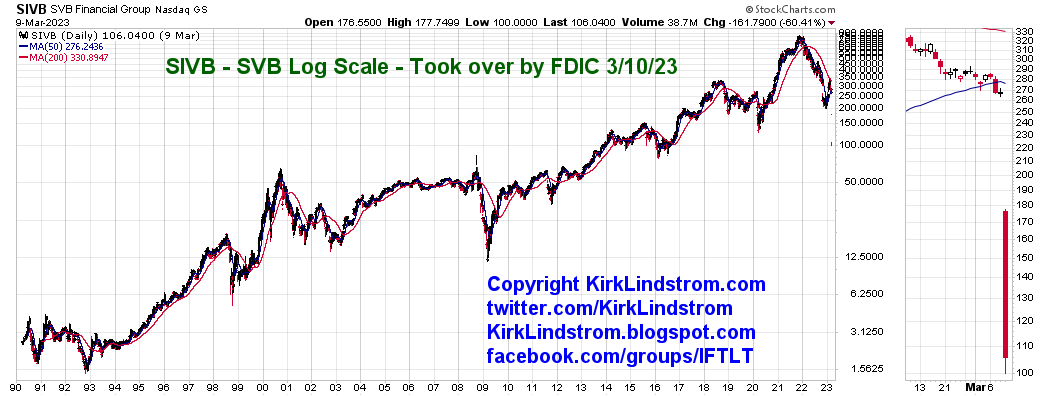

SIVB Fails. This is quite the story of a bank failure (taken over by "regulators" aka FDIC.) In a nutshell they needed to raise funds to meet withdrawals from customers wanting some of their funds on deposit to buy higher yielding US treasuries or even money funds at brokers paying well over 4%. To raise the funds, they had to sell some of their own US treasury portfolio at a loss because they bought those bonds when rates were low and they were paying next to nothing on deposits.

From FDIC Press Release: FDIC Creates a Deposit Insurance National Bank of Santa Clara to Protect Insured Depositors of Silicon Valley Bank, Santa Clara, California

My Facebook Discussion: Silicon Valley Bank collapses after failing to raise capital

Reminder, you can subscribe to this feed for free to get sent emails by Google when I post new charts and articles. Just click "Follow" below.

WASHINGTON – Silicon Valley Bank, Santa Clara, California, was closed today by the California Department of Financial Protection and Innovation, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. To protect insured depositors, the FDIC created the Deposit Insurance National Bank of Santa Clara (DINB). At the time of closing, the FDIC as receiver immediately transferred to the DINB all insured deposits of Silicon Valley Bank.All insured depositors will have full access to their insured deposits no later than Monday morning, March 13, 2023. The FDIC will pay uninsured depositors an advance dividend within the next week. Uninsured depositors will receive a receivership certificate for the remaining amount of their uninsured funds. As the FDIC sells the assets of Silicon Valley Bank, future dividend payments may be made to uninsured depositors.Silicon Valley Bank had 17 branches in California and Massachusetts. The main office and all branches of Silicon Valley Bank will reopen on Monday, March 13, 2023. The DINB will maintain Silicon Valley Bank’s normal business hours. Banking activities will resume no later than Monday, March 13, including on-line banking and other services. Silicon Valley Bank’s official checks will continue to clear. Under the Federal Deposit Insurance Act, the FDIC may create a DINB to ensure that customers have continued access to their insured funds.As of December 31, 2022, Silicon Valley Bank had approximately $209.0 billion in total assets and about $175.4 billion in total deposits. At the time of closing, the amount of deposits in excess of the insurance limits was undetermined. The amount of uninsured deposits will be determined once the FDIC obtains additional information from the bank and customers.Customers with accounts in excess of $250,000 should contact the FDIC toll-free at 1-866-799-0959.The FDIC as receiver will retain all the assets from Silicon Valley Bank for later disposition. Loan customers should continue to make their payments as usual.Silicon Valley Bank is the first FDIC-insured institution to fail this year. The last FDIC-insured institution to close was Almena State Bank, Almena, Kansas, on October 23, 2020.

The problem is after the Fed raised rates so quickly, assets held in longer term, low yield US Treasuries when "marked to market" are worth much less now. IF held to term, US Treasury holders will get their money back plus interest but if they need the money now, such as meeting depositors removing their liquid cash to get CA tax free, higher yield US treasuries from a broker or directly from the US treasury, then they are sold at a loss.

Kirk Lindstrom's Investment Letter

To see what stocks and ETFs are in my "Explore Portfolio" and get a full list of on my price targets to both take profits or buy more:

Subscribe NOW and get

the March 2023 Issue for FREE!!!

(If you mention this ad)

the March 2023 Issue for FREE!!!

(If you mention this ad)

No comments:

Post a Comment