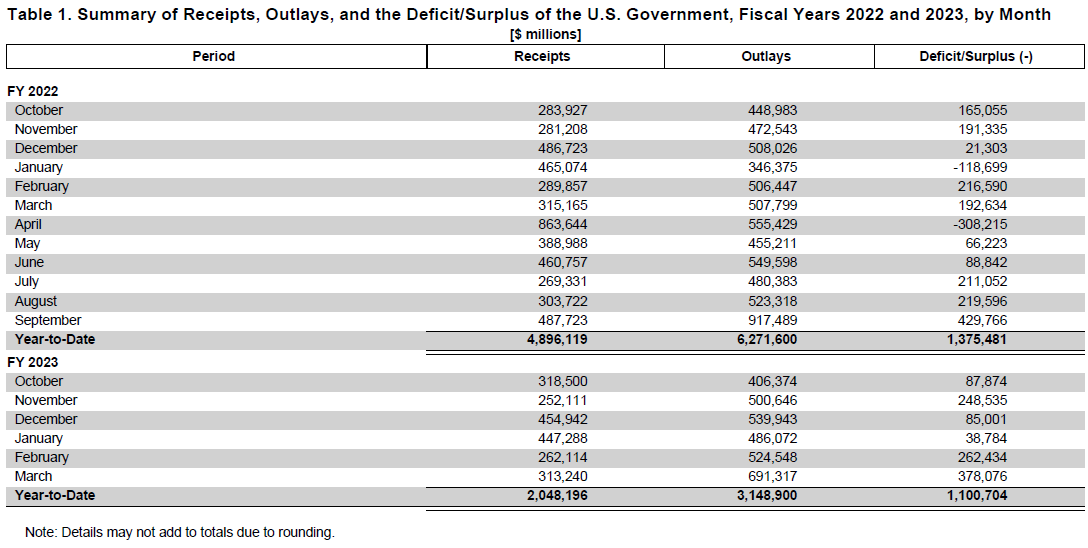

I updated my revenue, spending & deficit table for the US Treasury with the latest numbers.

- Revenue (taxes and fees) is not keeping up with inflation much less growing as you would expect if the economy was healthy

- Spending is soaring, much like a recession.

- Deficits, as a result, have already soared to $1.1 Trillion at the half way mark of fiscal 2023 while they didn't pass $1 trillion until the 12 month of fiscal 2022.

With requirements for "Estimated Tax Payments" to be paid four times a year, this is usually a very "lumpy" series thus I add calculations to show how these data change for the same period in the prior year. For example, April 2022 saw revenue increase by 96.6% as many tax payers paid their capital gains taxes on their fantastic 2021 gains. What I look for is trends such as the current trend of Treasury Revenue falling month-over-month for five consecutive months despite inflation of over 5% during that period. If we were to adjust the March 2023 reading by March's 5.0% inflation, "real revenue" collected by the Treasury fell by 5.6% which is hardly a healthy economy.

A healthy, growing US economy should have this revenue moving higher to match GDP growth, which is inflation adjusted, plus inflation.

Selected excerpts from the Monthly Treasury Statement

Cumulative Receipts, Outlays, and Surplus/Deficit through Fiscal Year 2023

Kirk Lindstrom's Investment Letter

the April 2023 Issue for FREE!!!

(If you mention this ad)

xxx

No comments:

Post a Comment