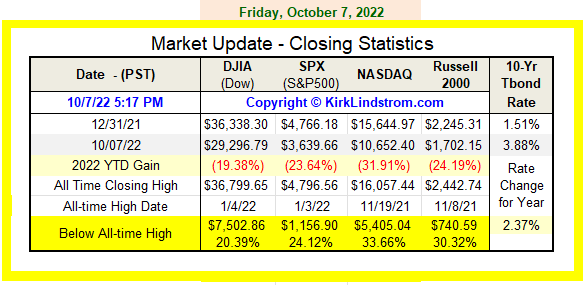

The bear market that began at the start of the year continues with all four major markets I follow down over 20% from their peaks.

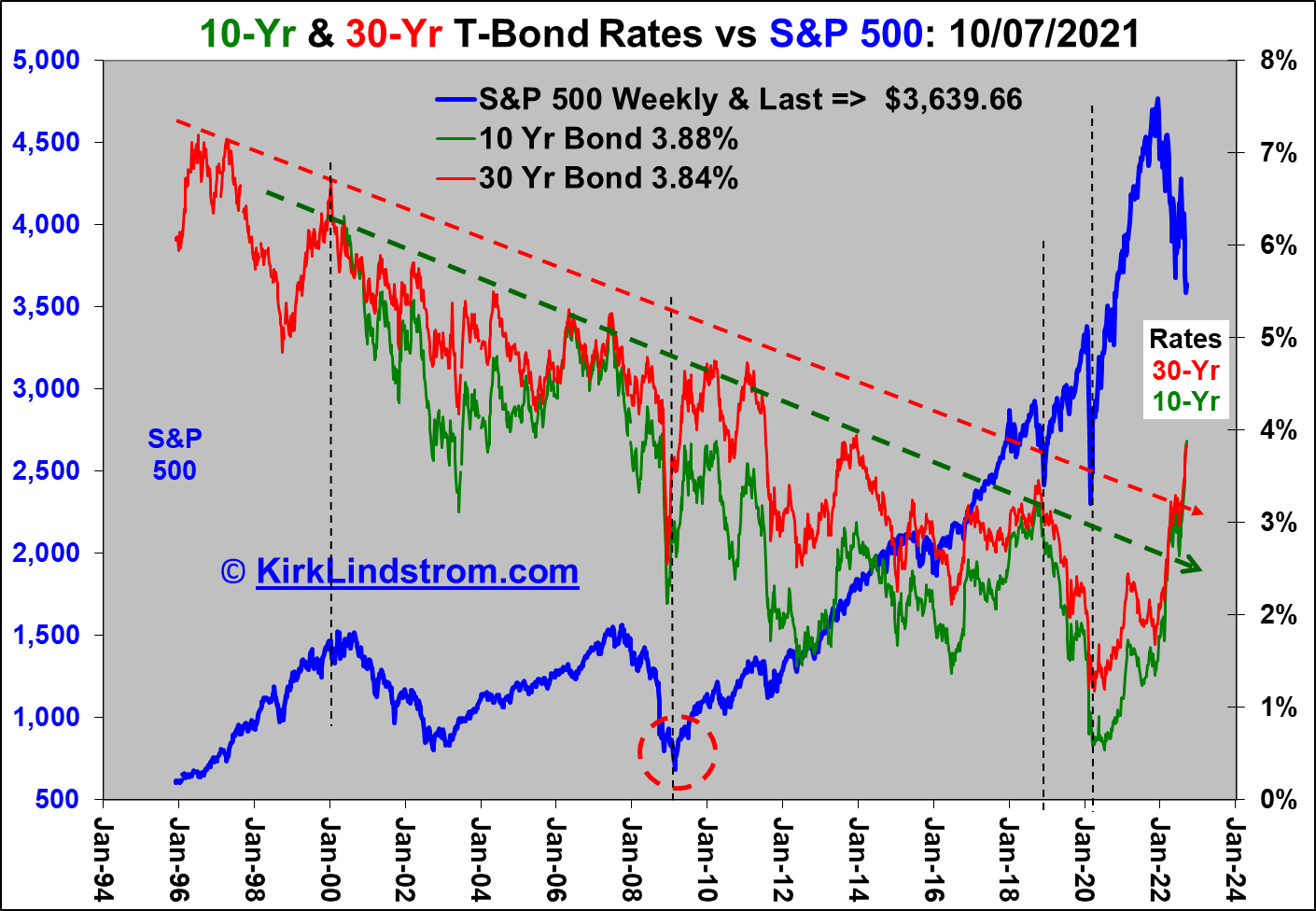

Interest rates continue to rise. Mortgage rates broke above 7% while the 10-year US Treasury, just below 4.0%, is near its high in over a decade.

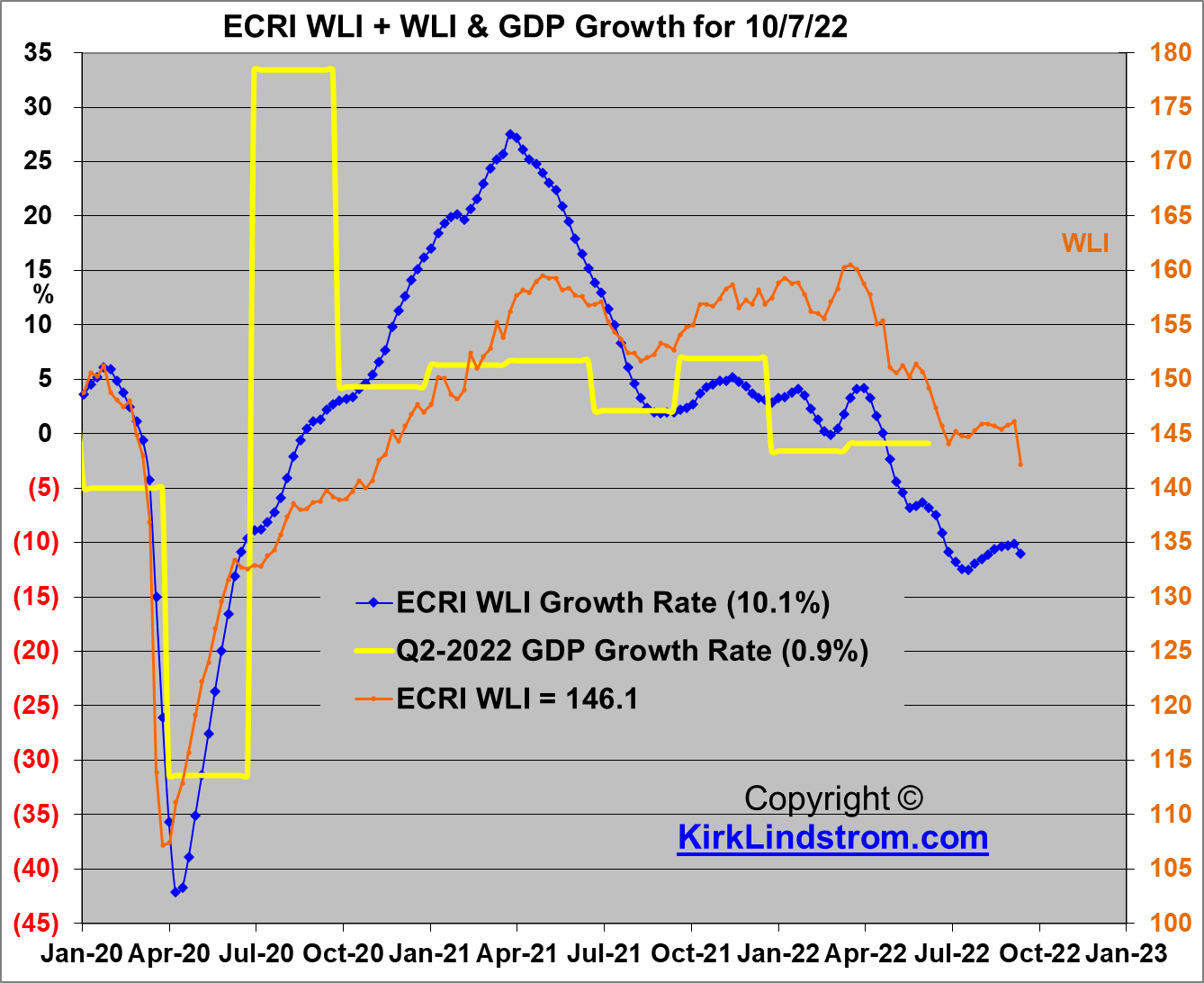

For many weeks, ECRI"s Weekly Leading Index, WLI, had given some hope as it slowly worked higher, but this week saw the reading for 9/30/22 fall off a cliff on the day the markets made their lows for the year.

|

| ECRI's WLI, WLI Growth Rate & Quarterly GDP Growth Graph. $SPX $SPY $DIA $QQQ |

US Stock Markets (Log Scale) vs. Fed Funds Rate

10-Yr & 30-Yr T-Bond Rates vs S&P 500

$TNX $TYX $SPX $SPY #InterestRates #Treasury Rates

$TNX $TYX $SPX $SPY #InterestRates #Treasury Rates

Kirk Lindstrom's Investment Letter

To see what stocks and ETFs are on my buy list and what are my price targets:

Subscribe NOW and get

the October 2022 Issue for FREE!!!

(If you mention this ad)

the October 2022 Issue for FREE!!!

(If you mention this ad)

No comments:

Post a Comment