Market Update through September 30, 2022

📉🐻The first three quarters of 2022 saw all four major stock market indexes reach bear market levels.

The DJIA and Wilshire 2000 small cap index have done much worse, surrendering gains back to before the pandemic began in March 2000!

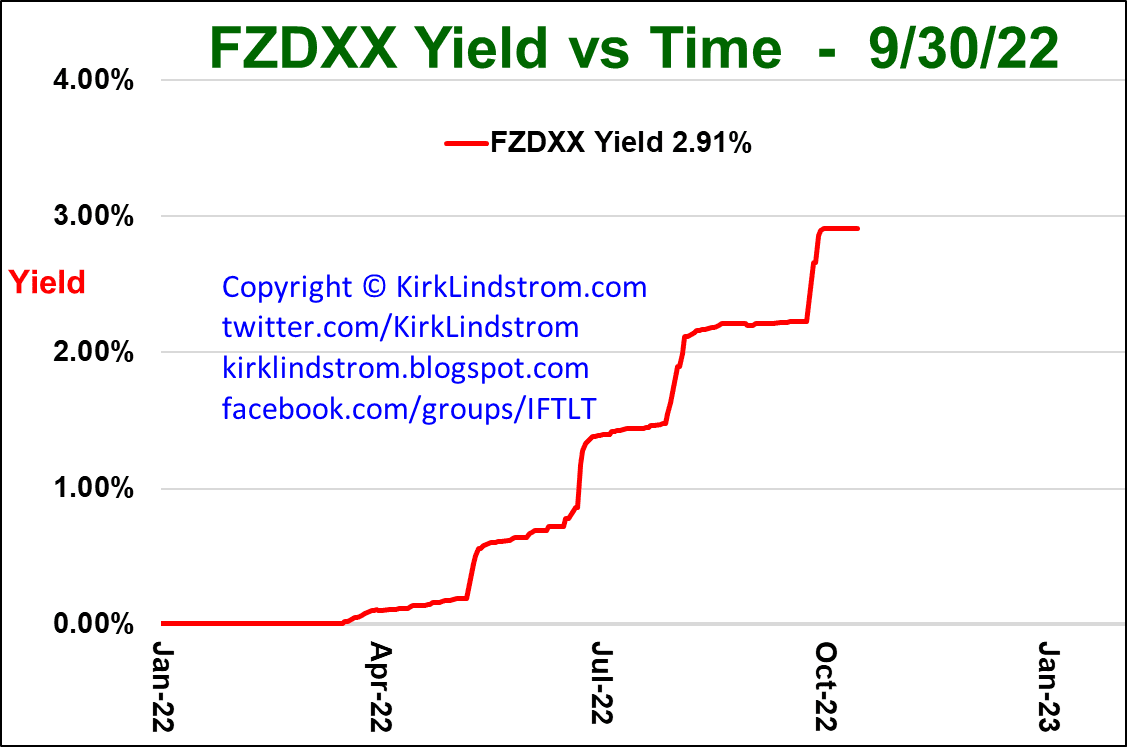

Due to my profit taking, positions in cash (FZDXX) and iBonds plus some dip buying then profit taking in the August rally, my "Explore Portfolio" is ahead of the S&P 500 this year by 5.4%. But, I'm still down which never feels good. Of course I have a huge advantage over the "buy and hold forever" crowd that didn't raise any cash during the record highs to use now to buy stocks back at much lower prices.

The good news is with TIAA (There is an Alternative) now in that short term money funds pay a decent return but they are still getting crushed by inflation, which is where my iBonds are helping. See Current Rates for New & Older I Bonds

From Bloomberg: BofA Strategists See Wall Street Rout Forcing Asset Sales

...accumulated losses could be forcing funds to sell more assets to raise cash, accelerating the selloff, according to Bank of America.

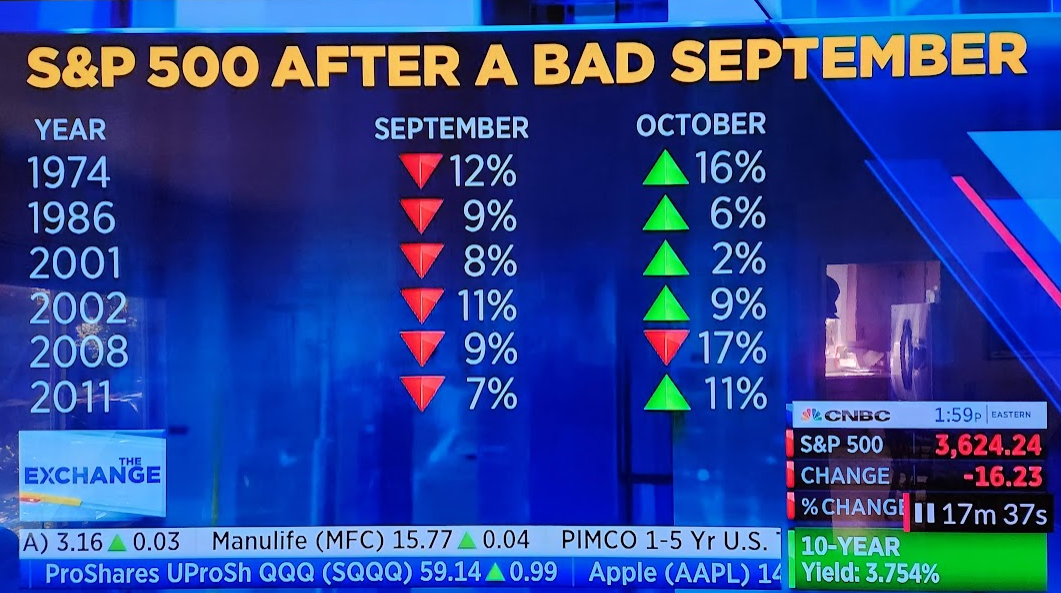

... Stocks are falling again Friday, with the S&P 500 heading toward its third straight quarter of losses for the first time since 2009 and the Nasdaq 100 Stock Index for the first time in 20 years.

...BofA strategists said to “bite” into the S&P 500 at the 3,300 level -- about a 9% decline from the latest close, “nibble” at 3,600 and “gorge” at 3,000. Hartnett and his team added that a drop of 20% below 200-day moving average has been a good entry point back into stocks in the past 100 years.

the September 2022 Issue for FREE!!!

(If you mention this ad)

No comments:

Post a Comment