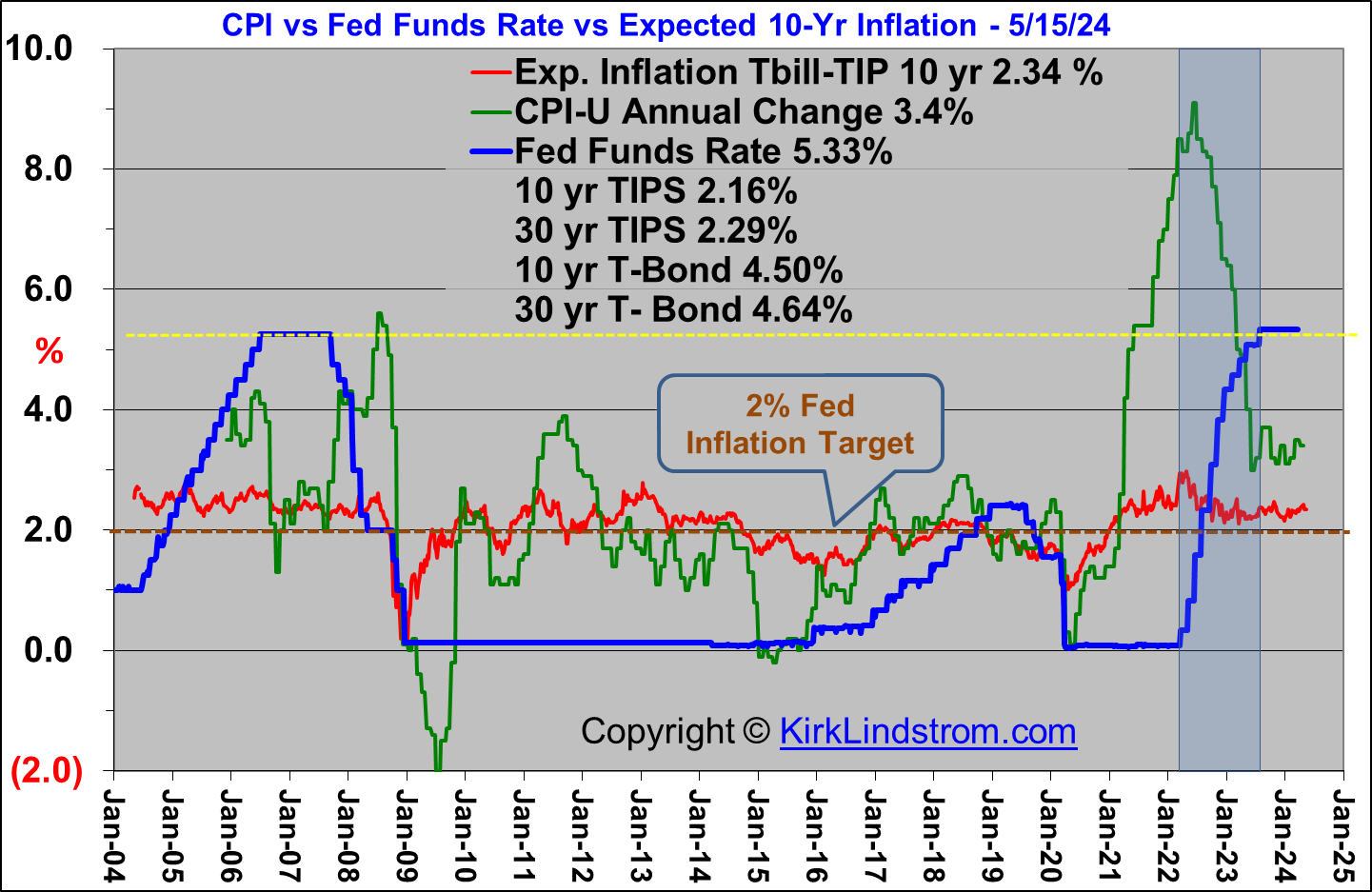

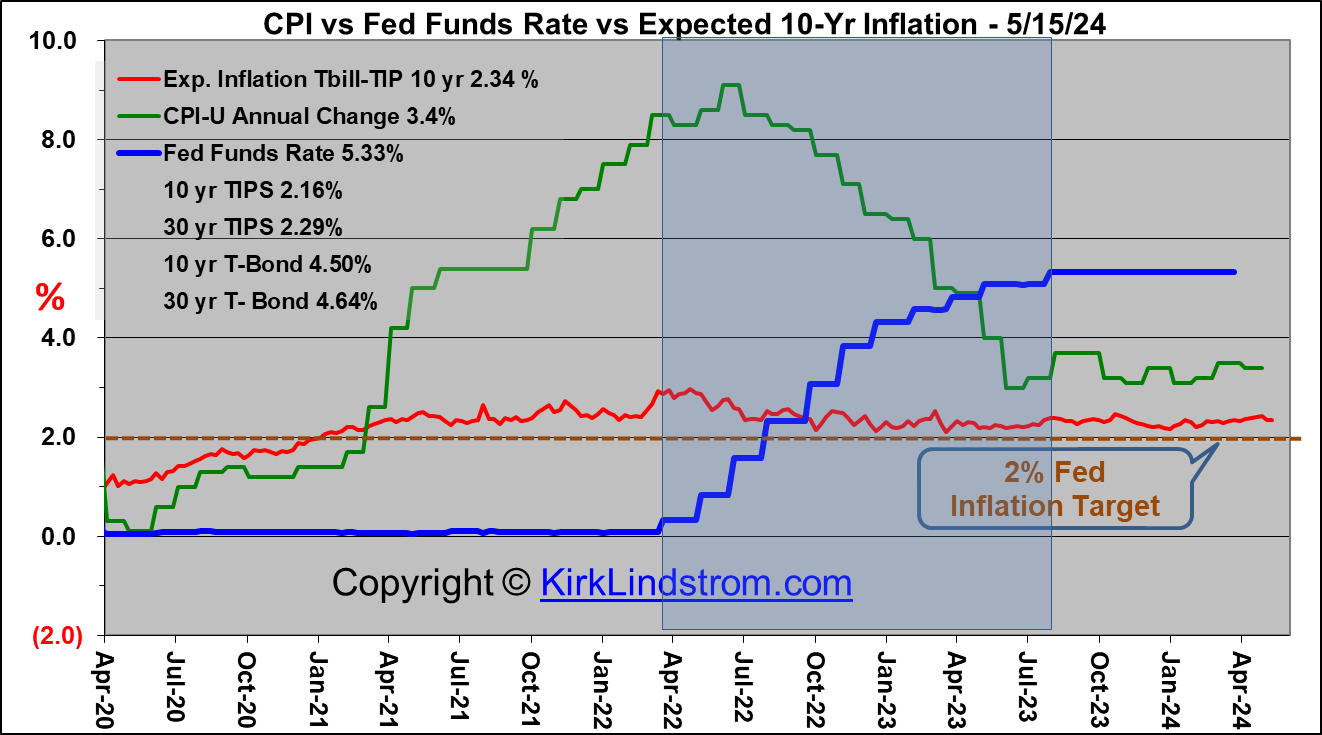

Despite President Biden's "Inflation Reduction Act of 2022" (estimated to contain $500B in new spending and tax credits) and the Federal Reserve keeping its Fed Funds Interest Rate at a 20-year high, inflation at 3.4% is 1.4% or 70% above the desired or "target rate" of 2.0%.

CPI-U: This morning the US Bureau of Labor Statistics announced, "The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.3 percent in April on a seasonally adjusted basis, after rising 0.4 percent in March". and "Over the last 12 months, the all items index increased 3.4 percent before seasonal adjustment."

Core CPI-U: "The index for all items less food and energy rose 0.3 percent in April, after rising 0.4 percent in each of the 3 preceding months." and "The all items less food and energy index rose 3.6 percent over the last 12 months."

Chart: CPI vs Fed Funds Rate vs Expected 10-Yr Inflation from 2004

Chart: CPI vs Fed Funds Rate vs Expected 10-Yr Inflation from 2020

Table: Raw Inflation Data from October 2023

Chart: Fed Funds Interest Rate vs S&P 500 - 1993 through today

Chart: Fed Funds Interest Rate vs S&P 500 - 2019 through today

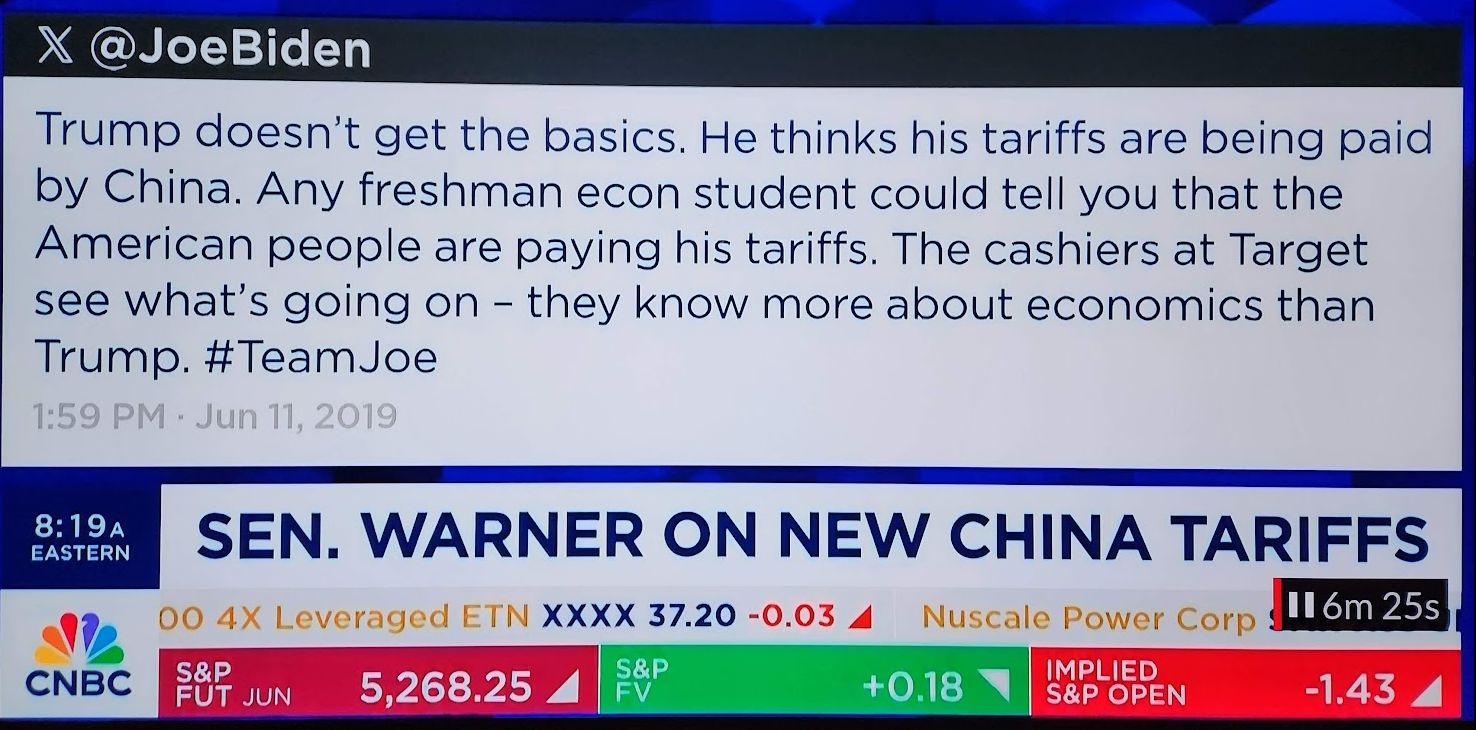

WASHINGTON, May 14 (Reuters) - President Joe Biden is hiking tariffs on $18 billion in Chinese goods including electric vehicles, batteries, semiconductors, steel, aluminum, critical minerals, solar cells, ship-to-shore cranes, and medical products, while retaining Trump-era tariffs on over $300 billion in goods.

The United States Trade Representative's Office told Reuters it anticipates the effective date will be in approximately 90 days.

Kirk Lindstrom's Investment Letter: To see what stocks and ETFs are in my "Explore Portfolio" and get a full list of on my price targets to both take profits or buy more:

the May 2023 Issue for FREE!!!

No comments:

Post a Comment