This photo of my TV screen tuned to CNBC this morning highlights the provisions of the GOP tax plan that both the Senate and the House of Representatives are getting close to an agreement on.

The GOP plan wanted to raise money to offset lowering taxes on the wealthy by forcing small investors like me to sell our oldest shares first when taking profits. Even if you just bought the SPY exchange traded index fund and reinvested dividends and wanted to take some profits, then the rule would have forced you to into a backdoor higher capital gain tax by forcing you to sell the old shares at much lower prices before you could sell the new shares reinvested near the market top!

Last week, as part of "rebalancing" and "taking profits," I sold all my reinvested SPY dividends in a taxable account just in case this rule passes. This made a big tax hit so this week I've sold shares in some stocks that are down to offset SOME of these gains.

If you sold stock using the GOP's proposed FIFO (First In First Out) rule, then it would be insane to reinvest dividends in taxable accounts. That would have been bad for the markets as many might spend the money rather than reinvest.

Why it matters:

Let's say you bought Intel (INTC) 20 years ago and reinvested dividends. Under current rules, investors can "take profits" by selling the higher priced reinvested dividend shares before they have to sell the much cheaper original shares.

Although I am not looking forward to other states subsidizing most of the high taxes I pay in California with the new GOP tax plan, I am happy to learn that for now the FIFO rule is out.

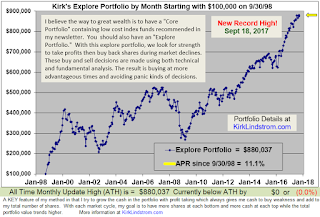

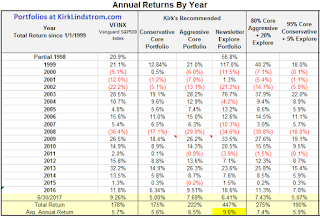

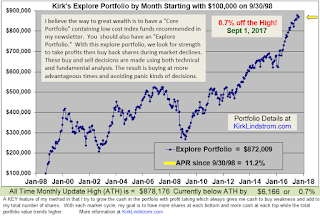

Kirk Lindstrom's Investment Letter

Subscribe NOW and get the December 2017 Issue for FREE!!!

(My SPECIAL ALERT emails will begin immediately plus access to all past issues while your 1 year, 12 issue subscription will start with the December issue.